Loading

Get Va 64.2-600 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 64.2-600 online

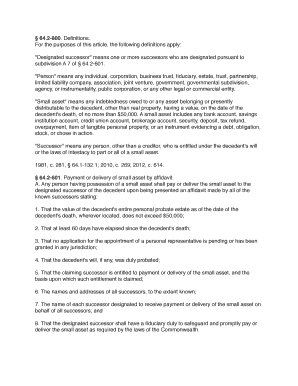

The VA 64.2-600 form is essential for individuals tasked with managing small assets belonging to a decedent. This guide will provide you with clear, step-by-step instructions for completing the form online, ensuring a smooth process for all users, regardless of their legal experience.

Follow the steps to complete the VA 64.2-600 form online effectively.

- Use the ‘Get Form’ button to access the VA 64.2-600 form and open it in your preferred document editor.

- Begin filling out the necessary fields, including the decedent's details, such as their name, date of death, and any relevant identification numbers.

- Provide the information on the designated successor, ensuring their name and contact details are accurately recorded.

- Indicate the value of the decedent's entire personal probate estate, confirming that it does not exceed $50,000 as required by section 64.2-601.

- Include all known successors’ names and addresses and your basis for entitlement to the small asset.

- Review your entries for accuracy and completeness, paying special attention to required statements about the decedent’s will and the absence of other applications.

- Save your changes to the form, and consider downloading a copy for your records. You can also print it or share it with relevant parties as needed.

Complete your forms online today to ensure timely management of small assets.

Related links form

Heirs/Heirs at Law: the persons who would inherit the decedent's estate if the decedent died intestate, as determined by law at the time of the decedent's death.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.