Loading

Get Tx 05-169 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

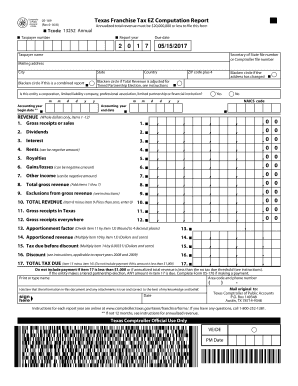

How to fill out the TX 05-169 online

This guide provides clear instructions for completing the TX 05-169 form online. Follow these steps to ensure your filing is accurate and compliant with Texas tax regulations.

Follow the steps to successfully complete your TX 05-169 form.

- Click ‘Get Form’ button to access the TX 05-169 form. This will allow you to fill out the necessary fields online.

- Enter your taxpayer number in the designated field. This is essential for identification purposes.

- Provide the report year by entering the four-digit year in the appropriate section.

- Fill in the due date. Make sure to use the format shown in the form.

- Input your taxpayer name and either the Secretary of State file number or Comptroller file number.

- Complete the mailing address section, including city, state, country, and ZIP code plus 4.

- If applicable, blacken the circle for combined reports or if total revenue is adjusted for tiered partnership election.

- Indicate the type of entity by checking the appropriate box for corporation, limited liability company, or other categories.

- Provide the accounting year begin and end dates, ensuring they comply with the requirements.

- If your address has changed, indicate this by blackening the appropriate circle.

- Enter your NAICS code if applicable.

- Fill in the revenue section. Report whole dollar amounts for gross receipts, dividends, interest, rents, royalties, gains/losses, and other income.

- Calculate the total gross revenue by summing up items 1 through 7.

- Complete exclusions from gross revenue if required, and calculate your total revenue based on the noted instructions.

- Provide gross receipts in Texas and everywhere, then calculate the apportionment factor as guided.

- Determine apportioned revenue and calculate tax due before any discounts.

- If applicable, calculate any discounts and finalize your total tax due. Ensure to follow the guidelines provided for amounts.

- Print or type your name, provide your area code and phone number, and declare that the information provided is accurate.

- Complete the filing by saving your changes and choosing to download, print, or share the completed form as necessary.

Start completing your TX 05-169 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The main difference between Texas forms 05-158 and 05-169 lies in the specific details they require for your franchise tax report. Form 05-158 is generally used for revenue below the threshold, while 05-169 is for those with different requirements based on revenue levels. Familiarizing yourself with these forms can prevent confusion and ensure compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.