Loading

Get Canada T1-ovp-s E 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

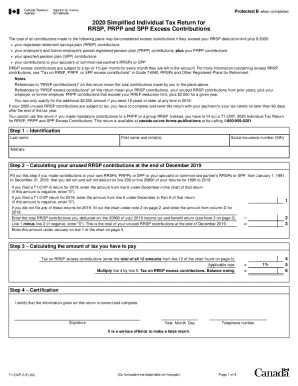

How to fill out the Canada T1-OVP-S E online

Filling out the Canada T1-OVP-S E form can be straightforward if you follow the necessary steps. This guide provides a clear and comprehensive approach to completing the form online, ensuring that you meet all requirements efficiently.

Follow the steps to successfully fill out your Canada T1-OVP-S E form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal identification information, including your last name, first name and initial(s), social insurance number (SIN), and address.

- For Step 2, calculate your unused RRSP contributions at the end of December 2019. Input any relevant contributions made from January 1, 1991, to December 31, 2019, which you did not deduct on prior returns.

- Proceed to Step 3, where you will calculate the total amount of tax owing on your RRSP excess contributions by multiplying the applicable rates.

- Complete Step 4 by certifying the information. You will need to sign, date, and provide a valid telephone number to confirm the accuracy of your submission.

Complete your Canada T1-OVP-S E form online to ensure accuracy and timeliness.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.