Loading

Get Ca Finrc-bl-cbd-r - Berkeley City 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FINRC-BL-CBD-R - Berkeley City online

This guide provides detailed instructions on completing the CA FINRC-BL-CBD-R form online. Designed for users of all experience levels, it breaks down each section of the form to ensure a seamless filing process.

Follow the steps to successfully complete the CA FINRC-BL-CBD-R form.

- Press the ‘Get Form’ button to obtain the CA FINRC-BL-CBD-R form and open it in your chosen editor.

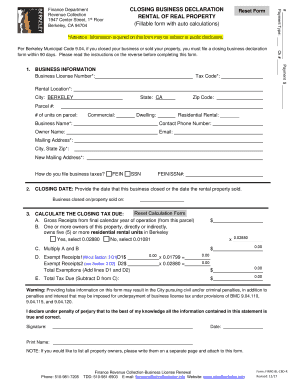

- Begin by filling out the Business Information section. Enter your business license number, tax code, and rental location details including city, state, and zip code.

- Continue by providing the contact information. Enter the business name, contact phone number, owner name, email, and mailing address.

- In the Closing Date section, enter the date that the business closed or the rental property was sold.

- Proceed to calculate the closing tax due. First, enter the gross receipts from the final calendar year of operation in line A.

- On line B, indicate whether any owner of the property owns five or more residential rental units in Berkeley. This determines the applicable tax rate.

- Multiply the entries from lines A and B to calculate the amount on line C.

- If applicable, complete line D by entering any exempt receipts based on the specified categories and calculating the total exemptions.

- Finally, subtract the exemptions from the total calculated tax due in line E. Review all entries for accuracy.

- Once all sections are complete, you can save changes, download the form, print it, or share it as necessary.

Complete your CA FINRC-BL-CBD-R form online today for a smooth filing experience.

Related links form

The City of Berkeley's transfer tax rate is 1.5% for properties up to $1.8M and 2.5% for properties over $1.8M. The City of Berkeley charges a transfer tax any time real estate changes ownership.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.