Loading

Get Ma Form 1 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Form 1 online

This guide provides a step-by-step approach to successfully completing the MA Form 1 online. It is tailored to assist all users, including those with limited legal experience, in navigating the form efficiently and accurately.

Follow the steps to complete the MA Form 1 online.

- Press the ‘Get Form’ button to obtain the MA Form 1 and open it in your preferred online editor.

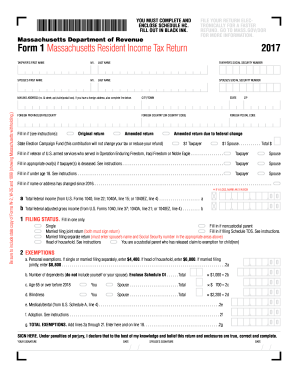

- Begin by entering your first name, middle initial, and last name in the designated fields for the taxpayer. If applicable, fill in the spouse's first name, middle initial, and last name as well.

- Input the taxpayer's Social Security number and the spouse's Social Security number in the respective boxes.

- Provide your mailing address, ensuring to include the street number and name, any apartment or suite number, city or town, state, and ZIP code. If you have a foreign address, complete the additional required fields.

- Indicate whether you are filing an original return, an amended return, or an amended return due to a federal change by selecting the appropriate option.

- Fill in your contribution to the State Election Campaign Fund, if desired. Indicate if you want to contribute $1 as the taxpayer, spouse, or both.

- If you are a veteran of the U.S. armed services with the specified service background, mark the appropriate checkbox.

- Indicate if either the taxpayer or spouse is deceased, whom it applies to. Refer to the instructions on the form if necessary.

- Complete the exemption section, detailing personal exemptions, number of dependents, and any applicable conditions such as age or disability.

- In the income section, report wages, salaries, tips, and other compensation, followed by other sources of income like pensions and unemployment compensation.

- Navigate to the deductions section to report any applicable deductions, including child care expenses and other deductions that apply to your situation.

- Review the total income tax section to calculate your total income tax using the provided tax table or any related schedules.

- Include any available credits, ensuring to provide details for each credit claimed.

- Finally, complete the refund and additional payment sections. Decide how you would prefer to receive refunds or make payments and fill in the necessary banking information.

- Once you have completed all sections, review the form for accuracy. Save your changes, download the completed form, or print it if you need a hard copy.

Ready to take the next step? Complete your MA Form 1 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Anyone who earns income while living in Massachusetts is required to file a state tax return if they meet specific income thresholds. This includes residents, part-year residents, and certain non-residents gaining income from Massachusetts sources. For accurate guidance, consider using platforms like uslegalforms to ensure compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.