Loading

Get Sba Form 2483-sd 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA Form 2483-SD online

Filling out the SBA Form 2483-SD online can seem challenging, but this guide is designed to help you navigate each section with ease. Follow these steps to ensure your application is completed accurately and efficiently.

Follow the steps to fill out the SBA Form 2483-SD online.

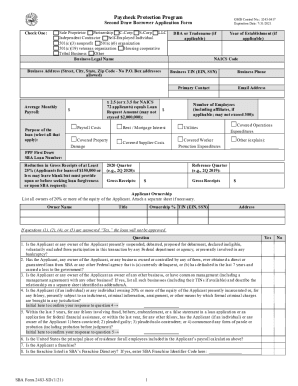

- Click the ‘Get Form’ button to access the SBA Form 2483-SD. This action will allow you to view and fill out the form in an online editor.

- Begin by entering the business legal name in the designated field. Ensure that this reflects the official name of your entity as registered.

- Provide the business address. Remember that P.O. Box addresses are not acceptable; you must use a physical street address.

- Indicate your average monthly payroll by calculating the total payroll costs for the applicable period and dividing by the number of months.

- Select the purpose of the loan by checking all relevant boxes. This typically includes options like payroll costs, rent, mortgage interest, and utilities.

- Determine the loan request amount, which can be calculated by multiplying the average monthly payroll by either 2.5 or 3.5, depending on your business type.

- Enter the DBA or tradename if applicable, followed by the year of establishment, NAICS code, business TIN, and business phone.

- Fill in the primary contact information, including the email address and number of employees. Remember to include yourself if applicable.

- Answer questions regarding eligibility by checking 'Yes' or 'No' where applicable. If necessary, provide additional information on separate sheets.

- Complete the certification and signature section, where the authorized representative must acknowledge the accuracy of the information provided.

- Once you have completed all sections, you can save your changes, then download the form to print or share as needed.

Complete your documents online today to ensure a smooth application process!

Related links form

For each individual employee, the total amount of cash compensation eligible for forgiveness may not exceed an annual salary of $100,000, as prorated for the Covered Period. For an 8-week Covered Period, that total is $15,385. For a 24-week Covered Period, that total is $46,154 for purposes of this 3508EZ.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.