Loading

Get Al Dor 40v 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL DoR 40V online

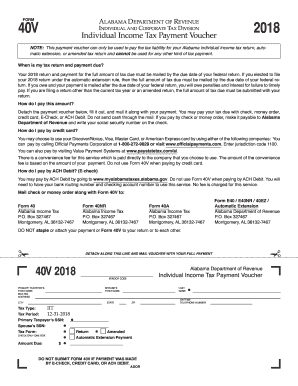

The AL DoR 40V form serves as the individual income tax payment voucher for Alabama. It is crucial for users to correctly fill out this form to ensure timely and accurate payment of their tax liabilities.

Follow the steps to accurately complete the AL DoR 40V form.

- Press the ‘Get Form’ button to access the AL DoR 40V form and open it for completion.

- Provide the primary taxpayer's full name. Enter their first name, last name, and Social Security Number in the designated fields.

- Fill out the mailing address details. Ensure that the street address, city, state, and zip code are correctly entered.

- If applicable, include the spouse's first name and last name, along with their Social Security Number.

- Indicate the tax type and period by selecting the appropriate check box for Return, Amended, or Automatic Extension Payment.

- Clearly input the amount due for tax payment in the designated field.

- Enter the daytime telephone number for either the primary taxpayer or the spouse to ensure contact availability.

- Review all entered information for accuracy. Make sure all fields are complete before proceeding.

- When ready, save your changes to the form, then download, print, or share it as needed.

Complete your filing for the AL DoR 40V online now to ensure timely payment of your tax liabilities.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain an Alabama withholding tax number, you need to complete an application process through the Alabama Department of Revenue. This process usually entails providing essential business information and completing the necessary forms as outlined in the AL DoR 40V material. For convenience, the uslegalforms platform can guide you through the steps to secure your withholding tax number efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.