Loading

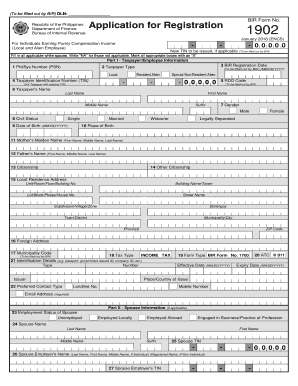

Get Ph Bir 1902 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1902 online

Filing the PH BIR 1902 form online is an essential process for individuals earning purely compensation income in the Philippines. This guide provides a clear and supportive approach to help users navigate each section of the form with ease.

Follow the steps to complete the PH BIR 1902 form online effectively.

- Press the ‘Get Form’ button to access the BIR Form 1902 and open it in the designated platform for completion.

- Begin with Part I - Taxpayer/Employee Information. Fill in your PhilSys Number (PSN) if applicable, choose your taxpayer type (Local, Resident Alien, or Special Non-Resident Alien), and provide your Taxpayer Identification Number (TIN). Note the BIR Registration Date and complete the Taxpayer’s Name fields (last name, first name, and middle name).

- Indicate your gender, civil status, and date of birth. Provide your place of birth and both parents' names as requested. It is important to ensure that all names are spelled correctly.

- Next, input your citizenship details along with your local residence address, making sure to include complete information like building number, street name, municipality, and ZIP code.

- If applicable, provide your foreign address and municipality code as per the guidelines. Fill in details regarding your identification documents, including the type, number, and issuer.

- Proceed to Part II - Spouse Information if applicable. Include your spouse’s employment status, full name, TIN, and details regarding their employer.

- Continue to Part III if you have multiple employers within the calendar year. Indicate the type of employment (successive or concurrent) and provide details of previous and/or concurrent employers.

- Review and complete the declarations at the end of the form, ensuring that you understand and acknowledge the penalties for perjury by signing over your printed name.

- In Part IV, fill in information related to your current or primary employer, including the employer’s name and contact details, as well as the relationship start date.

- Once all information is accurately filled in, save your changes, and explore options to download, print, or share the completed form as needed.

Begin filling out your PH BIR 1902 form online now to stay compliant with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The only way to get your new TIN for employees is via your employer. They are the only ones who can do this. This can be done by creating an account in BIR eReg here. Once your employer has an account, they fill-out the form for enrollment then processes everything.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.