Loading

Get Ak Form 662 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 662 online

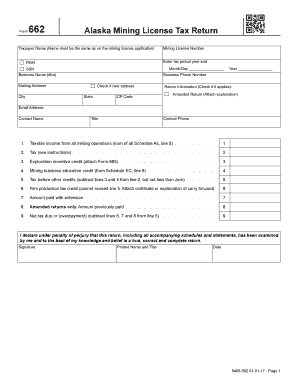

The AK Form 662 is essential for reporting the Alaska mining license tax return. This guide will provide thorough instructions to assist users in filling out this form accurately and efficiently online.

Follow the steps to complete the AK Form 662.

- Use the ‘Get Form’ button to acquire the form and open it in your online editor.

- Begin by entering your taxpayer name, ensuring it matches the name on your mining license application. Next, input your mining license number, tax period year-end, FEIN, SSN, and business name.

- Fill in your business phone number, mailing address, and check the box if your address has changed. Then, enter your city, state, and ZIP code.

- Provide your email address, contact name, and title, along with a contact phone number for further inquiries.

- Proceed to report your taxable income from all mining operations. This figure should reflect the total from all Schedule As, line 8.

- Calculate your tax as instructed and enter the amount. Then, indicate any exploration incentive credit by attaching Form 665 if applicable.

- Document the mining business education credit derived from Schedule EC, line 6.

- Determine tax before other credits by subtracting lines 3 and 4 from line 2, ensuring that the result does not fall below zero.

- If applicable, list any film production tax credit — this cannot exceed the results from line 5, and attach necessary certificates or explanations of carry forward.

- Record the amount paid with extension, and if you're submitting an amended return, indicate any amount previously paid.

- Finally, compute your net tax due or overpayment by subtracting lines 6, 7, and 8 from line 5.

- Review all entries carefully, declare under penalty of perjury that the return is truthful, and proceed to sign by entering your printed name, title, and date.

- After completing the form, options to save changes, download, print, or share will be available in your online editor.

Complete your AK Form 662 online today to ensure compliance and timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Many companies and tax entities now offer the option to access your K-1 form online through their dedicated portals. Check with your partnership or S corporation's website for digital access. If they do not provide this option, you may need to contact them directly. Furthermore, for assistance with tax-related forms, including the AK Form 662, you can rely on US Legal Forms for accessible templates and guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.