Loading

Get Uk Hs304 Claim Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HS304 Claim Form online

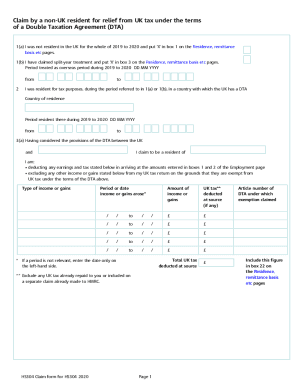

Filing the UK HS304 Claim Form online allows users who are non-UK residents to claim relief from UK tax under the terms of a Double Taxation Agreement. This guide provides step-by-step instructions to ensure you accurately complete the form online, making the process as straightforward as possible.

Follow the steps to complete the UK HS304 Claim Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete section 1(a) by indicating that you were not a UK resident for the entire tax year of 2019 to 2020. Place an ‘X’ in box 1. If applicable, fill in section 1(b) to claim split-year treatment by putting ‘X’ in box 3. Provide the relevant dates for the overseas period you are treating.

- In section 2, specify the country where you were a tax resident during the relevant period, including the exact dates. Ensure your country of residence has a Double Taxation Agreement with the UK.

- Section 3(a) requires you to declare your residency status under the DTA with the UK, and list any income and taxes deducted at source. Fill in the respective fields for each type of income or gains you are claiming exemption for, ensuring to include the amounts of UK tax that were deducted.

- If applicable, complete section 3(b) by providing details of income for which you claim partial relief. List the nature of the income, the gross amount, the tax rates under the DTA, and calculate the relief claimed.

- Answer questions in sections 4, 5, and 6 regarding previous claims and whether you wish to make additional claims. Ensure you check the relevant boxes accurately.

- In the declaration section, confirm that you hold beneficial entitlement to the income described, and ensure that you sign and date the form before submitting it. Make sure all information filled is accurate to the best of your knowledge.

- After filling out all sections, save your changes, and prepare to download or print the completed form for submission.

Complete the UK HS304 Claim Form online today to ensure your tax relief is claimed accurately.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.