Loading

Get Income Tax Calculation Statement - Rsgc.ac.in

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INCOME TAX CALCULATION STATEMENT - Rsgc.ac.in online

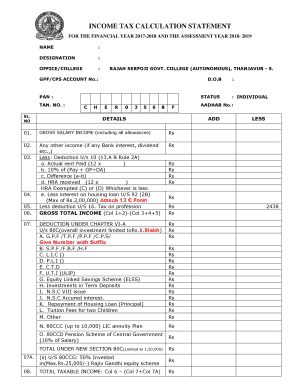

This guide provides a detailed walkthrough for completing the INCOME TAX CALCULATION STATEMENT required for the financial year 2017-2018. Following these instructions will help users accurately fill out the document online, ensuring compliance and clarity in reporting income and deductions.

Follow the steps to efficiently complete the income tax calculation statement.

- Click 'Get Form' button to obtain the form and open it in your preferred editing tool.

- Begin by entering your personal details in the designated fields, including your name, designation, office or college, and relevant identification numbers such as GPF/CPS Account No., date of birth, PAN, and TAN.

- Fill in your gross salary income, including all allowances, in the 'Gross salary income' section. If applicable, add any other income like bank interest or dividends.

- In the deductions section (U/s 10), calculate your actual rent paid and other components like HRA received and HRA exempted to determine the amount you may claim as exemption.

- Continue to the 'Gross total income' section where you will include your total income and subtract total deductions. This will provide your gross total income.

- Detail your deductions under Chapter VI-A U/s 80C, including various investments and contributions. Ensure each entry corresponds to its correct field.

- Calculate your total taxable income by subtracting the total deductions from your gross total income.

- Proceed to determine your tax liability based on applicable income brackets and enter the calculated taxes.

- Account for any tax credits you are eligible for and calculate the final tax payable.

- Review all entries for accuracy, ensure you've filled in all necessary fields, and make any final adjustments.

- Once completed, you can either save changes, download, print, or share the form as needed.

Complete your income tax calculation statement online to ensure timely and accurate compliance.

Under Section 127(A) of the Tax Code, as amended by the Tax Reform for Acceleration and Inclusion (TRAIN) Law, the STT rate is 6/10 of 1% based on the gross selling price or gross value in money of the shares of stock sold, bartered, exchanged or otherwise disposed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.