Loading

Get W-8ben-e Example Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the W-8BEN-E Example Form online

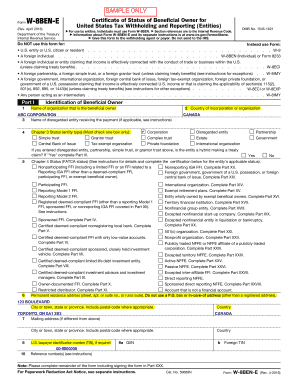

Filling out the W-8BEN-E form online can seem complex, but understanding its components and sections will make the process easier. This guide provides clear, step-by-step instructions to help you accurately complete the form.

Follow the steps to effectively complete the W-8BEN-E form.

- Press the ‘Get Form’ button to obtain the W-8BEN-E form and open it in your preferred document editor.

- In Part I, provide the name of the organization that is the beneficial owner in the designated field.

- Enter the country of incorporation or organization. Ensure that the country is recognized under the relevant tax treaties.

- If applicable, enter the name of any disregarded entity receiving the payment in the specified section.

- Select your entity's status for Chapter 3 by checking one box indicating the type of entity (e.g., Corporation, Tax-exempt organization, etc.).

- Complete the Chapter 4 Status (FATCA Status) by checking the box that applies to your entity. Follow the instructions relevant to your selected status.

- Fill in the permanent residence address of the entity, ensuring not to use a P.O. box.

- If required, provide the U.S. Taxpayer Identification Number (TIN) and Foreign TIN where appropriate.

- Complete Parts II to XV if they are applicable to your entity's specific circumstances or status.

- Make sure to sign and date the form in Part XXX, certifying the information provided.

- Once all sections are complete and verified, save your form electronically. You may also download, print, or share it as necessary.

Begin filling out the W-8BEN-E form online today to ensure compliance with tax regulations.

Form W-8BEN is used by foreign individuals who receive nonbusiness income in the U.S., whereas W-8BEN-E is used by foreign entities who receive this type of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.