Loading

Get Debt To Income Calculator

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Debt To Income Calculator online

Understanding your debt to income ratio is crucial for managing your finances effectively. This guide will walk you through the process of using the Debt To Income Calculator online, helping you to accurately assess your financial situation.

Follow the steps to fill out the calculator correctly.

- Click ‘Get Form’ button to access the calculator and open it in your preferred online method.

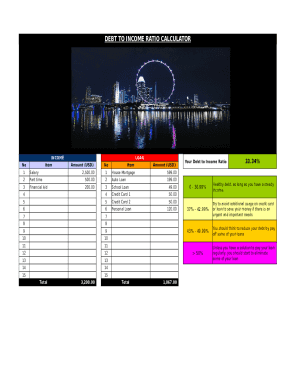

- In the income section, enter your sources of income. You may include items such as your salary, part-time job earnings, or financial aid. Make sure to record the amounts next to each income source accurately.

- Next, move to the loan section. Input all your outstanding loans including mortgage, auto loans, credit cards, and any personal loans. Enter the respective amounts for each loan type.

- Once you have filled out all fields in both the income and loan sections, review your entries to ensure accuracy. It's essential that the total income accurately reflects monthly earnings and total debt includes all relevant financial obligations.

- After verifying your input, the calculator will automatically compute your debt to income ratio. Assess the ratio provided to understand your financial health.

- Finally, you can save your changes, download, print, or share the results of your calculations for future reference or discussions with financial advisors.

Start managing your finances effectively by completing the Debt To Income Calculator online today.

A debt-to-income ratio of 20% or less is considered low. The Federal Reserve considers a DTI of 40% or more a sign of financial stress.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.