Loading

Get Financial Needs Analysis Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Financial Needs Analysis Questionnaire online

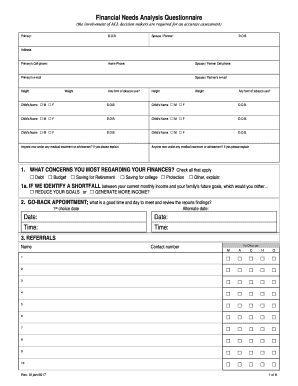

The Financial Needs Analysis Questionnaire is a vital tool for assessing your financial situation and planning for your future. This guide provides clear, step-by-step instructions to help you complete the questionnaire online with confidence.

Follow the steps to effectively complete your questionnaire.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out the primary information section, which includes your date of birth, contact details, and basic health information. Be thorough and ensure your entries are accurate.

- In the spouse/partner section, provide similar information for your partner. This ensures that their financial situation is also considered.

- Enter details about your children, including their names and dates of birth, as well as any relevant health information.

- In the concern section, check all financial worries that apply to you, such as debt or retirement savings. Take your time to reflect on your financial goals.

- Answer the follow-up question regarding income shortfalls, indicating your preference to reduce goals or generate more income.

- Schedule your go-back appointment by selecting dates and times that work for your review. This is important for your overall financial planning.

- Proceed to fill out the income section, including your primary and spouse/partner’s monthly income. Make sure to review your paycheck stubs for accuracy.

- Detail your retirement plans, including current contributions and employer matching, as well as any pension plans you may have.

- List any non-retirement assets and their current values, as well as any other appreciable assets outside of your home.

- Fill out the emergency fund section, indicating whether you have a separate emergency account and its balance.

- Indicate any education savings plans you have started and specify how much you wish to contribute to future education expenses.

- Provide details about your other goals and dreams, such as vacations or home improvements, and include any associated costs.

- Complete the legal services section, indicating whether you have a will or trust and what plans you would like to make regarding guardianship.

- Enter information about any additional insurance premiums you pay and the types of coverage you have.

- Describe your employer-provided life insurance and its coverage details.

- Fill out the income protection needs section to assess your family's financial security in the event of unforeseen circumstances.

- Provide detailed information regarding your personal life insurance policies, including coverage amounts and plan types.

- Estimate your coverage needs and whether that coverage should assist your family in maintaining their current standard of living.

- List your actual monthly expenses. Assess how you make payments to determine the impact on your financial health.

- Complete the investment profile to align your investment strategies with your financial goals and risk tolerance.

- Once you have filled out all sections, review your responses for accuracy and completeness.

- Save your changes, then download, print, or share the completed form as needed.

Start completing your Financial Needs Analysis Questionnaire online now.

A financial needs analysis (FNA) is an overview of your current and future financial situation. It takes into account assets, such as wealth and income, set off against liabilities, such as debt and dependents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.