Loading

Get Financial Balance Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Financial Balance Sheet online

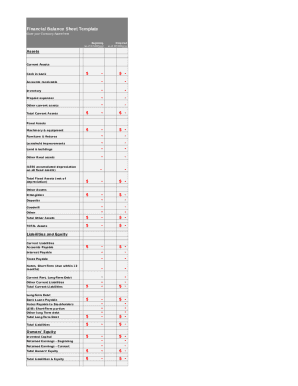

Filling out a financial balance sheet is an essential task for businesses to assess their financial health. This guide provides straightforward instructions for completing the financial balance sheet online, ensuring clarity at every step.

Follow the steps to complete your financial balance sheet accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your company name at the designated field at the top of the form.

- In the 'Beginning as of mm/dd/yyyy' field, specify the date for which you are presenting the current financial information.

- Under the 'Projected as of mm/dd/yyyy' section, provide the anticipated financial details for the specified future date.

- Navigate to the 'Assets' section starting with 'Current Assets.' Fill in the fields for accounts receivable, inventory, prepaid expenses, and any other current assets, ensuring to enter the values accurately.

- Proceed to 'Total Current Assets' and calculate the sum of all current assets entered. This value should auto-calculate or be manually entered, based on your entries.

- Move to 'Fixed Assets' where you will list land & buildings, machinery & equipment, and furniture & fixtures. With each asset, include its corresponding value.

- Deduct accumulated depreciation on all fixed assets, then complete the 'Total Fixed Assets (net of depreciation)' section with the final calculated value.

- In the 'Other Assets' section, fill in intangibles and deposits, then calculate 'Total Other Assets.'

- Sum up all sections to arrive at the 'TOTAL Assets,' providing a comprehensive view of all assets your business holds.

- Next, move to the 'Liabilities and Equity' section, starting with 'Current Liabilities.' Enter values for accounts payable, current part of long-term debt, and other current liabilities to get 'Total Current Liabilities.'

- Insert long-term debt values into the respective field and compute the 'Total Long-Term Debt.'

- Calculate 'Total Liabilities,' which should encompass both current and long-term liabilities combined.

- Finally, provide information for 'Owners' Equity' and calculate the 'Total Liabilities & Equity' to ensure both sides of the equation balance.

- Once all fields are completed, you can save changes, download, print, or share the form as needed.

Start filling out your financial balance sheet online to manage your business's financial information effectively.

To prepare a balance sheet, you need to calculate net income. Net income is the final calculation included on the income statement, showing how much profit or loss the business generated during the reporting period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.