Loading

Get Simple Ira Contribution Form - Pctrucos Pesquisador

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Simple Ira Contribution Form - Pctrucos Pesquisador online

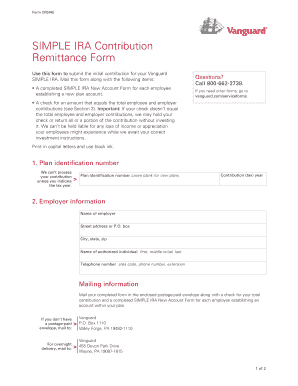

The Simple Ira Contribution Form - Pctrucos Pesquisador is used to submit contributions for your Vanguard SIMPLE IRA. This guide provides step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to successfully complete the contribution form.

- Click ‘Get Form’ button to obtain the Simple Ira Contribution Form - Pctrucos Pesquisador and open it in the editor.

- Fill in the plan identification number if you have an existing plan. Leave this field blank if this is a new plan and ensure to specify the contribution (tax) year.

- Enter the employer information. This includes the name of the employer, street address or P.O. box, city, state, zip code, name of the authorized individual (first, middle initial, last), and their telephone number with area code.

- In the contribution information section, list each employee's name alphabetically by their last name followed by their Social Security number and the respective contribution amounts.

- If you have additional employees, photocopy the page to add more entries. Ensure that the total contribution amount matches the check you will be submitting.

- Review all entered information for accuracy before finalizing your submission.

- You can now save changes, download, print, or share the completed form as necessary.

Complete your Simple Ira Contribution Form online today to ensure a seamless contribution process.

Employee SIMPLE IRA Contribution Limits for 2023 An employee cannot contribute more than $15,500 in 2023 ($14,000 in 2022) to a SIMPLE IRA. Employees age 50 or over can contribute an extra $3,500 as a catch-up contribution in 2023 ($3,000 in 2022).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.