Get California Tax Exempt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California Tax Exempt Form online

Filling out the California Tax Exempt Form can seem daunting, but with the right guidance, you can complete it with ease. This guide will provide you with step-by-step instructions to help you navigate the online form efficiently and correctly.

Follow the steps to complete your California Tax Exempt Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

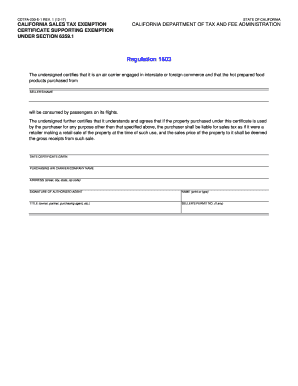

- In the first section, indicate the name of the seller by filling in the 'SELLER’S NAME' field. This is the vendor from whom you are purchasing the hot prepared food products.

- Next, enter the date when you are providing this certificate in the 'DATE CERTIFICATE GIVEN' field. Accurate dating is essential for record-keeping purposes.

- Fill in your company name in the 'PURCHASING AIR CARRIER/COMPANY NAME' field. Ensure that your company's legal name is used for proper identification.

- Enter the complete address of your business, including street, city, state, and zip code in the 'ADDRESS' field. This ensures that the seller can easily verify your location.

- An authorized agent must sign the form in the 'SIGNATURE OF AUTHORIZED AGENT' section. This confirms that the information provided is accurate and authorized.

- In the 'NAME (print or type)' field, type or print the name of the authorized agent who signed the form. This adds clarity about who is responsible for the form.

- Provide the title of the person signing the form, such as 'owner' or 'purchasing agent,' in the 'TITLE' field to clarify their role.

- If applicable, include the seller's permit number in the 'SELLER’S PERMIT NO.' field. This information may be necessary for verification purposes.

- Review all the fields for accuracy and completeness. Once confirmed, you can save the changes. You will have the option to download, print, or share the completed form as needed.

Start filling out your California Tax Exempt Form online today for a smooth and compliant process.

Related links form

Use Form 590, Withholding Exemption Certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. For more information, go to ftb.ca.gov and search for backup withholding.

Fill California Tax Exempt Form

This is also to certify that the property purchased will not be used to carry a payload or for any other purpose prior to its delivery at the destination point. Indicate if the parent organization has California tax-exempt status . Attach another sheet if necessary . Applicable To: Federal, state, and local government agencies. Required Form: Form CDTFA-101 – Exemption Certificate. Individually billed accounts (IBA) are not exempt from state sales tax. A Partial Exemption Certificate for Manufacturing, Research and Development Equipment (CDTFA-230-M) is required to be completed for every product. If you are selling to a customer who has an exempt status, you must collect a California Sales Tax Exemption certificate and keep it on file.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.