Loading

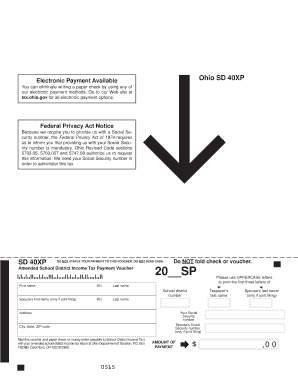

Get Ohio It 40xp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio It 40xp online

Filling out the Ohio It 40xp, the Amended School District Income Tax Payment Voucher, can be a straightforward process when done online. This guide provides clear and detailed steps to help you complete the form smoothly and ensure that all necessary components are addressed.

Follow the steps to accurately complete the Ohio It 40xp online.

- Click ‘Get Form’ button to access the Ohio It 40xp document and open it in your online editor.

- Enter your last name in uppercase letters as requested. This ensures that your name is clearly readable.

- Fill in the school district number associated with your filing in the designated field.

- Include your spouse’s first name, if applicable, for joint filing. If not filing jointly, this step can be skipped.

- Provide your middle initial (M.I.) in the specified area to complete your name details.

- Enter your first name in the appropriate field, ensuring proper spelling and format.

- If filing jointly, enter your spouse’s last name in the designated area.

- Input your Social Security number. Remember, providing this information is mandatory.

- In the next field, include your spouse’s Social Security number, if applicable.

- Fill out your complete address, including city, state, and ZIP code.

- Indicate the amount of payment you are submitting in the specified field, ensuring accuracy in the figure you provide.

- Review all entered information for accuracy and completeness, and make any necessary corrections.

- Once all details are confirmed, save your changes and download the completed form.

- You can now print the form or share it as needed. Remember to mail the printed voucher along with your check or money order to the indicated address.

Start filling out your Ohio It 40xp online today to streamline your tax filing process.

Amending a return is not unusual and it doesn't raise any red flags with the IRS. In fact, the IRS doesn't want you to overpay or underpay your taxes because of mistakes you make on the original return you file.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.