Loading

Get Penalty Charge Payment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Penalty Charge Payment Form online

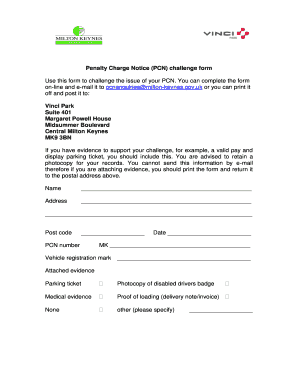

Filling out the Penalty Charge Payment Form online is a straightforward process that requires careful attention to detail. This guide will take you step-by-step through each section to ensure your submission is complete and accurate.

Follow the steps to successfully complete your online form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- In the first section, enter your full name. This information helps to identify you within the process.

- Next, provide your complete address. This includes your street, city, and state, as well as your zip code to ensure accurate communication.

- Enter your PCN number, which is typically located on the notice issued to you. This number is crucial for processing your challenge.

- Fill in the date of the notice. Make sure to use the date format specified on the form.

- Input your vehicle registration mark. Providing this information allows the authority to verify your vehicle details.

- In the attached evidence section, indicate the types of evidence you are including, such as a parking ticket or medical evidence. Remember to check the appropriate boxes.

- In the grounds of challenge section, clearly articulate the reasons for your challenge. Be concise, but detailed enough to support your argument.

- Finally, sign the form to confirm your understanding of the procedural details, and print your name along with the date to complete your submission.

- Once all fields are filled out, save your changes, and you may either email the completed form or print and post it, depending on your attached evidence.

Complete your Penalty Charge Payment Form online today to ensure your challenge is processed efficiently.

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.