Loading

Get Ak Form Treg 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form TREG online

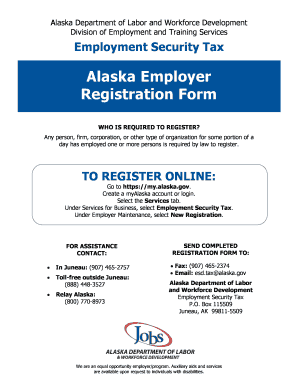

Filling out the AK Form TREG is an essential step for any individual or organization looking to register for Employment Security Tax in Alaska. This guide will provide you with clear, step-by-step instructions to help you complete the form confidently and accurately.

Follow the steps to complete your AK Form TREG online.

- Press the ‘Get Form’ button to access the AK Form TREG online and open it for editing. This will allow you to access all the fields required for your submission.

- At the top left of the form, check the appropriate box to indicate whether this is a new registration or an update to a previous registration. This distinction is crucial for processing.

- Identify your business entity by marking the box that accurately describes your organization. If you select ‘Nonprofit organization’ and meet the requirements of IRC 501(a) and 501(c)(3), you may opt for the reimbursable method of reporting.

- Enter your Federal Employer Identification Number (FEIN) in the designated field. Be sure to avoid using your Social Security Number as this is a legal requirement.

- If you have been previously assigned an account number by the Employment Security Tax, enter it in the specified field to ensure proper association with your history.

- Select whether you wish to provide coverage for excluded employees by checking ‘Yes’ or ‘No.’ If you mark ‘Yes,’ ensure to complete the necessary details on Page 3.

- Complete the section requesting the anticipated hiring of contract labor to perform your business activities in Alaska.

- Provide the date of acquisition of your business or entity change, including the month, day, and year in the required fields.

- Fill in the date you anticipate your business will pay the first payroll in Alaska.

- In the designated field, indicate the legal name of your business exactly as it is registered with the appropriate authority.

- If your business operates under a different name, enter the ‘doing business as’ (DBA) name in the specified field.

- Input your business mailing address accurately, ensuring that all details are correctly filled to avoid delays.

- Enter the phone number for your business to allow for contact if needed.

- Complete the physical worksite address in Alaska if it differs from your mailing address. If you have multiple worksites, list additional locations.

- Provide the contact information for your main business contact person including their name, phone number, email, and any additional required details.

- Describe the specific products or services that your business will be providing in Alaska. This detail is critical for determining your tax rates.

- Fill out any additional questions regarding your business acquisitions, including prior owner details and the number of employees acquired.

- Finally, ensure the form is signed and dated by the individual responsible for completing it, providing their printed name, title, phone number, and email for confirmation.

- Once all sections are completed, review the information for accuracy, then save any changes, and utilize options to download, print, or share the completed form as needed.

Start completing your AK Form TREG online today to ensure your registration is processed smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The unemployment rate in Alaska for 2025 can fluctuate based on numerous economic factors. This rate is an important indicator of economic health and workforce dynamics. To stay informed about the current unemployment rate and its implications, you can check resources like USLegalForms, which also guides you through the use of the AK Form TREG.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.