Get Irs 8809 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8809 online

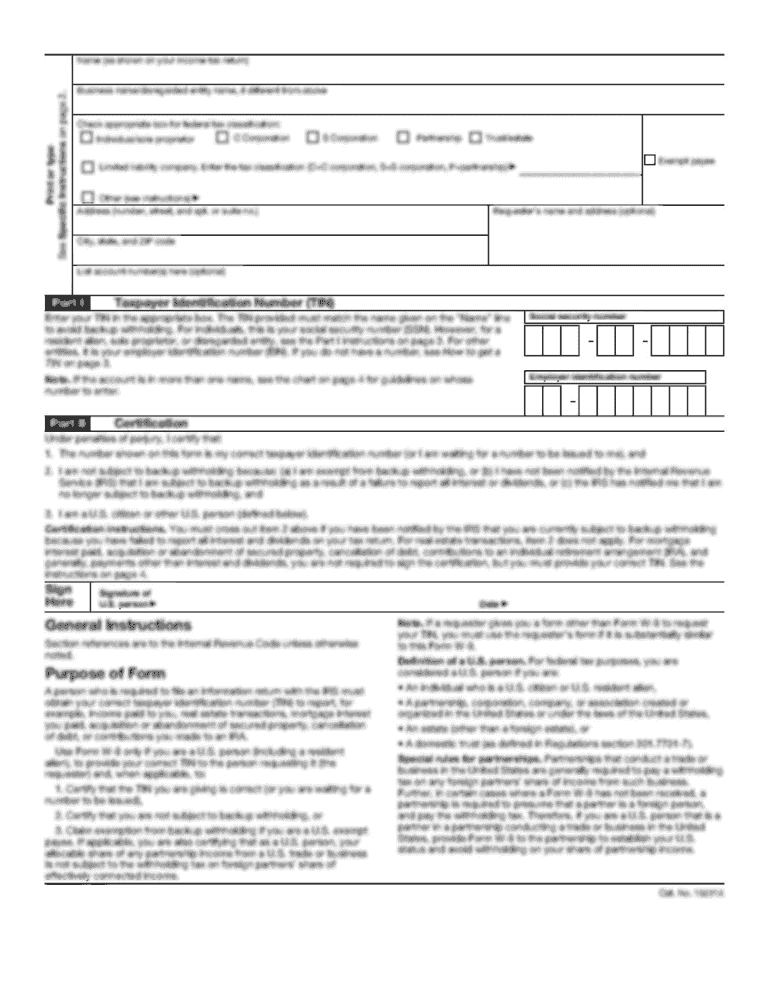

Filling out the IRS 8809 form is essential for those who need an extension of time to file certain information returns. This guide provides a detailed and supportive walkthrough of the process, ensuring that every user, regardless of their legal experience, can successfully navigate the online form.

Follow the steps to complete your IRS 8809 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section 1, enter the payer's or filer's information, including the name, address, city, state, ZIP code, contact name, telephone number, and email address. Ensure that all information is clearly typed or printed in black ink.

- For line 2, provide the taxpayer identification number (TIN), which is the payer's nine-digit number without hyphens.

- In line 3, select your method of filing information returns by checking only one box: either 'Electronic' or 'Paper'. If you are requesting an extension for multiple payers or filers, enter the total number on line 4 and attach a typed list if necessary.

- Line 5 should be checked only if you have previously requested an automatic extension and now need an additional extension. Complete line 7 if this applies.

- Discuss your reason for needing an extension in line 7. Check any applicable boxes that describe your situation, such as a catastrophic event, natural disaster, or serious illness.

- At the bottom of the form, you will need to provide your signature, title, and date. If you are filing for an automatic 30-day extension, no signature is required.

- Once you have completed all sections of the form, review it for accuracy. You can then save your changes, download a copy, print it, or share it as needed.

Begin the process of filing your IRS 8809 form online today to ensure timely processing and avoid any penalties.

Related links form

To obtain a copy of your SS4 form from the IRS, you should submit Form 4506-A. This form requests a transcript of your Form SS-4, which may help you retrieve your Employer Identification Number (EIN). If navigating this process feels overwhelming, platforms like US Legal Forms offer resources to guide you step-by-step, ensuring you secure your needed documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.