Loading

Get In Form Wh-4 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Form WH-4 online

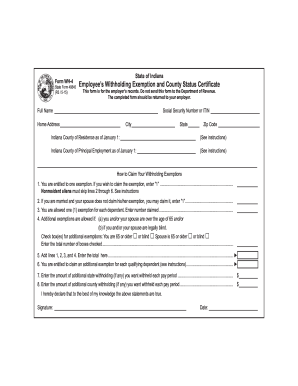

Filling out the IN Form WH-4 is essential for Indiana employees to ensure accurate tax withholding. This guide will walk you through each section of the form, offering clear instructions to help you complete it online with confidence.

Follow the steps to effectively fill out your IN Form WH-4.

- Press the ‘Get Form’ button to obtain the form and open it in your selected editing tool.

- Enter your full name, Social Security Number or ITIN, and home address in the designated fields. Make sure all information is accurate.

- In the section for Indiana County of Residence, enter the county in which you reside as of January 1. If you do not reside in Indiana, write 'not applicable'.

- For the Indiana County of Principal Employment, input the county where you work as of January 1. Use 'not applicable' if this does not apply to you.

- Claim your withholding exemptions. For line 1, if you wish to claim an exemption for yourself, enter '1'. Nonresident aliens should skip steps 2 through 6.

- For line 2, if you are married and your spouse does not claim their exemption, enter '1' to claim it for them.

- On line 3, declare the number of dependents you are claiming. Enter the total number of exemptions you wish to claim for your dependents.

- If you or your spouse are 65 or older or legally blind, check the appropriate box(es) for additional exemptions in line 4.

- Calculate the total exemptions by adding lines 1, 2, 3, and 4 and enter this total on line 5.

- For line 6, specify any additional exemptions for qualifying dependents as needed.

- On lines 7 and 8, enter any additional amounts you want withheld for state and county taxes respectively.

- Finally, ensure that you sign and date the form to declare the information provided is accurate before submitting it to your employer.

Compete your IN Form WH-4 online today to ensure smooth processing and accurate withholding!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You may need to fill out a W-4P form if you receive pension or annuity payments and want to specify withholding. Unlike the IN Form WH-4, which is generally for employment income, the W-4P form focuses on retirement income. It is crucial to assess your specific income sources to determine if this form applies to you. Providing accurate information helps you achieve appropriate tax withholding.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.