Loading

Get Dol 5500 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL 5500 online

Filling out the DoL 5500 form online can be a straightforward process when you understand its components and requirements. This guide aims to provide clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the DoL 5500 form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

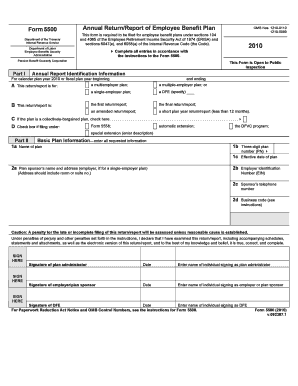

- Review the annual return identification information section. Enter the plan year, including the starting and ending dates, and check the applicable boxes indicating whether the return is for a single-employer, multiemployer, or multiple-employer plan.

- In Part II, provide basic plan information. Enter the name of the plan, the three-digit plan number, and the effective date of the plan. Make sure to include details about the plan sponsor, including their name, address, and Employer Identification Number (EIN).

- Complete the plan administrator section if it is different from the plan sponsor. This includes their name, address, EIN, and telephone number.

- Input the total number of participants at the beginning of the plan year and the number as of the end of the plan year. This encompasses various categories of participants, such as active, retired, and those entitled to future benefits.

- If applicable, check the boxes for pension and welfare benefit codes and complete the funding and benefit arrangement sections as required.

- Attach appropriate schedules as needed by selecting the relevant boxes and indicating the number of attached schedules.

- Review the form for accuracy, sign where indicated as the plan administrator and employer/plan sponsor, and date your entries.

- After completing the form, save the changes, and depending on your preferences, you can download, print, or share the filled-out form.

Start completing your DoL 5500 form online today for accurate reporting and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The 5500 audit is a mandated financial examination of employee benefit plans that exceed 100 participants. This audit verifies that the reported information on the Form 5500 is accurate and compliant with regulations. Such audits enhance trust in the management of retirement assets and ensure proper fiduciary practices. If you seek guidance in navigating an audit, uslegalforms offers resources to support you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.