Loading

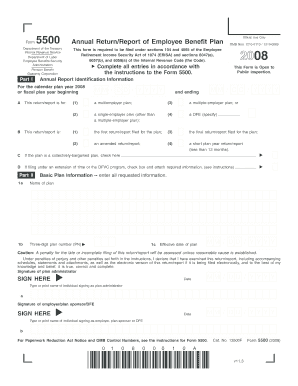

Get Dol 5500 2008

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL 5500 online

The Department of Labor (DoL) 5500 is an essential filing for employee benefit plans, providing critical information to regulators and the public. This guide offers clear and supportive instructions for completing the form online, helping users navigate every section efficiently.

Follow the steps to accurately complete the DoL 5500 form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

- In Part I, fill out the Annual Report Identification Information. Specify the calendar plan year or fiscal plan year beginning date, marking whether the plan is a multiemployer, single-employer, or other specified type, along with the return/report status.

- Proceed to Part II for Basic Plan Information. Enter the plan name, three-digit plan number, and effective date of the plan. Ensure accuracy to avoid penalties for late or incomplete filing.

- Provide the plan sponsor's and administrator's names, addresses, and contact information in the respective fields. Include the Employer Identification Number (EIN) and business code.

- Detail participant information in the sections provided, including counts of active, retired, and separated participants as necessary for your filing.

- Specify the types of benefits provided under the plan, such as pension and welfare benefits, by checking the appropriate boxes and entering the relevant feature codes.

- Indicate the plan funding and benefit arrangements by checking all applicable options. This information aids in the understanding of how the plan is structured financially.

- Attach any necessary schedules or additional documents as required, checking the appropriate boxes and entering the number of attachments.

- Before submitting, review the form for completeness and accuracy. Once satisfied, you can save changes, download, print, or share the form as necessary.

Start filling out your DoL 5500 form online today to ensure compliance and support for your employee benefit plan.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, most self-funded plans are required to file the DoL 5500 form annually. This requirement helps ensure transparency and compliance with federal regulations. If your plan falls under this category and you need assistance with filing, uslegalforms offers solutions to help you meet these obligations efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.