Loading

Get Wi Form 1952 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI Form 1952 online

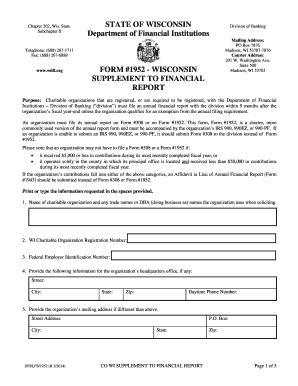

The WI Form 1952 serves as a crucial supplement to the annual financial report required for charitable organizations in Wisconsin. This guide provides a tailored approach to assist users in navigating the form effectively and ensuring compliance with state requirements.

Follow the steps to complete the WI Form 1952 online

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Begin by entering the name of the charitable organization, including any trade names or doing business as (DBA) names used during solicitations.

- Input the WI Charitable Organization Registration Number in the designated field.

- Provide the Federal Employer Identification Number of your organization.

- Fill in the information for the organization's headquarters office, including street address, city, state, zip code, and daytime phone number.

- If the organization has a mailing address different from the headquarters, complete the corresponding fields with the street address, city, state, and zip code.

- For any Wisconsin office, provide the necessary details. Attach additional pages if there are multiple offices.

- Enter the details of the person(s) who has custody of the organization’s financial records, including first name, last name, city, state, street, zip, and daytime phone number.

- Complete the section for the individual(s) responsible for the custody of contributions, ensuring all requested information is accurate.

- Fill out the details for someone within the organization who is available to answer questions regarding this form.

- Describe the charitable purposes for which contributions will be used. Alternatively, attach relevant documentation.

- Answer questions regarding the use of professional fund-raisers and provide corresponding information if applicable.

- Indicate if any changes to previously submitted information have occurred and describe those changes.

- Confirm whether the organization is authorized by any other state/governmental authority to solicit contributions.

- Consider any issues faced in the past year regarding solicitation authority and provide explanations if applicable.

- Address questions related to the accumulation of surplus in net assets and respond accordingly.

- Provide necessary details for any financial interests held by officers or directors in transactions made by the organization.

- Complete the financial information section, including the accounting period and method used, along with total contributions, revenues, and expenses.

- Check the box next to required attachments and ensure all accompanying documents are correctly attached.

- Lastly, make sure the document is signed by the chief fiscal officer and another authorized officer. Ensure to include the date and notary's information if required.

- After reviewing all entries for accuracy, save changes to the form, and proceed to download, print, or share it as necessary.

Complete your documentation online today to ensure compliance and maintain your organization's good standing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Wisconsin requires a minimum of three board members for a nonprofit organization. This structure promotes accountability and diverse perspectives in governing the organization. When forming your board, ensure you include this information when completing the WI Form 1952 for proper registration.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.