Get Pa Psrs-1127 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PSRS-1127 online

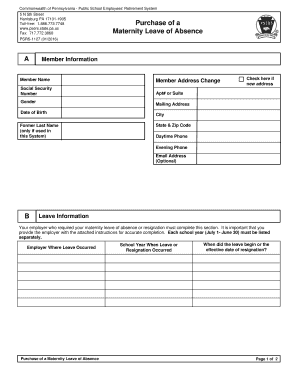

This guide provides users with clear and comprehensive instructions on how to complete the PA PSRS-1127 form for purchasing a maternity leave of absence. Designed for a broad audience, this step-by-step approach ensures clarity and accessibility for all users, regardless of legal experience.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the PA PSRS-1127 form and open it for editing.

- In Section A, fill in your member information, including your name, address, Social Security number, date of birth, and contact information. If applicable, check the box for a new address.

- Proceed to Section B, where you will provide details about your maternity leave information. Make sure to include the employer where the leave occurred, the school year corresponding to the leave, and the effective dates.

- Move to Section C and enter the name and date of birth of each child for whom the leave was taken. Remember that only biological children can be listed; adoptive information is not applicable.

- In Section D, sign and date the form in the Member Certification area to validate your request for the cost to purchase service credit for your maternity leave.

- Once the form is completed, save your changes and you may download, print, or share the completed PA PSRS-1127 form as needed.

Complete your PA PSRS-1127 form online today to ensure a smooth process for your maternity leave purchase.

The retirement multiplier for PA teachers under PA PSRS-1127 is essentially the same as the typical teacher pension multiplier, at 2.5% per year of service. This multiplier is crucial in determining the overall pension benefits you will receive upon retirement. Planning wisely using this information can pave the way for a comfortable retirement. Check US Legal Forms for valuable resources to support your planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.