Loading

Get Or Tse Ap

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Or Tse Ap online

Filling out the Or Tse Ap form can be a straightforward process when you have clear guidance. This comprehensive guide provides step-by-step instructions to help you complete the form efficiently.

Follow the steps to fill out the Or Tse Ap form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

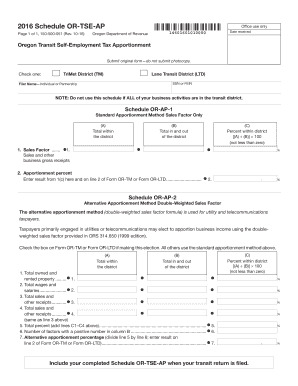

- Begin by selecting the appropriate transit district you are filing for, either TriMet District or Lane Transit District.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the respective field.

- Fill in your name as the filer, identifying whether you are an individual or a partnership.

- Complete Schedule OR-AP-1 by entering the total sales and other business gross receipts within the district in column A, and the total in and out of the district in column B.

- Calculate the percentage within the district using the formula [(A) ÷ (B)] × 100, and enter this result in column C.

- Transfer the result from step 6 into line 2 of either Form OR-TM or Form OR-LTD as indicated.

- If applicable, complete Schedule OR-AP-2 for those using the alternative apportionment method by following similar steps, entering totals for property, wages, and receipts as needed.

- After filling in all required information, review the form for accuracy before submitting.

- Once completed, save your changes, then proceed to download, print, or share the form as required.

Start filling out your Or Tse Ap form online today!

1. How much is the self employment tax for Oregon? The self employment tax refers to your share of Social Security and Medicare, two federal taxes. If you are a self employed business owner, then you will need to pay a tax rate of 15.3% and will need to be added on to your income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.