Loading

Get Scotiabank Tax Residency Self Certification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scotiabank Tax Residency Self Certification online

The Scotiabank Tax Residency Self Certification is an important document for confirming the tax residency of account holders. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring users have the necessary information to navigate each section effectively.

Follow the steps to successfully complete your Tax Residency Self Certification

- Press the ‘Get Form’ button to access the Scotiabank Tax Residency Self Certification form.

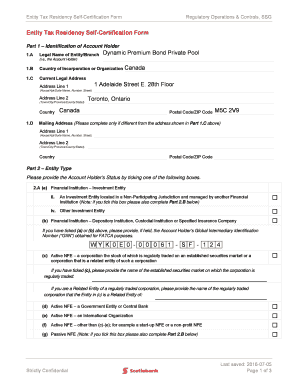

- In Part 1, provide the legal name of the entity or branch as well as the country of incorporation or organization. Fill in the current legal address, including both address lines, city, province/state, and postal/ZIP code.

- If the mailing address is different from the legal address, complete the mailing address section with the necessary details.

- In Part 2, select the appropriate entity type by checking one of the available boxes that describes the account holder’s status, such as financial institution or other investment entity.

- If applicable, provide the Global Intermediary Identification Number (GIIN) for FATCA purposes in the specified field provided for it.

- For passive entities, indicate the names of any controlling persons in the designated area and ensure to complete a separate 'Controlling Person Tax Residency Self-Certification' form for each controlling person listed.

- In Part 3, complete the table by indicating the country/jurisdiction of tax residence and providing the Taxpayer Identification Number (TIN) where available. If no TIN is available, select the appropriate reason (A, B, or C) and explain if necessary.

- Finally, in Part 4, read the declaration statement carefully and certify your authorization to sign the form. Provide your signature, printed name, capacity, and the date of signing.

Complete your documents online with confidence and accuracy!

As per agreement signed under FATCA and CRS, all financial institutions are required to provide the necessary information to Indian tax authorities, who will in turn transmit the same to the respective jurisdiction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.