Loading

Get If You Are Filing For The Medical Expense Benefit Only Under Your Accident Policy, A Claim Form May

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the If you are filing for the medical expense benefit only under your accident policy, a claim form may online

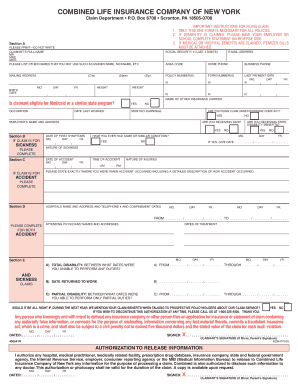

This guide provides clear instructions on completing the claim form for medical expense benefits under your accident policy. Following these steps will help ensure your submission is accurate and timely, facilitating the processing of your claim.

Follow the steps to complete your claim form online

- Click ‘Get Form’ button to obtain the claim form and open it in the editor.

- Fill out the claimant information on the first page. Ensure you include your full name and current mailing address, as this is where any payments or correspondence will be sent.

- Enter your policy numbers on the form to expedite processing. If applicable, indicate whether you are filing due to sickness or an accidental injury.

- If applicable, provide details regarding your hospitalization, including the name and address of the hospital, as well as your admission and discharge dates.

- If you are claiming disability, specify the exact dates of your total and/or partial disability, ensuring accuracy for timely processing.

- Sign and date the Authorization to Release Information section at the bottom of the form to avoid delays.

- Have your attending physician complete the Second Page, specifically the Attending Physician’s Statement, which requires their assessment of your condition.

- If you are employing disability coverage, ensure your employer completes the Employer’s Statement located at the top of the Second Page.

- Keep a copy of the completed claim form and any accompanying bills for your records, noting the date you mailed them.

- Mail both pages of the completed form along with any necessary enclosures to the address provided in the instructions.

Complete your claim form online to expedite your medical expense benefits.

DEDUCT GYM MEMBERSHIPS Health club or gym memberships are also considered a deductible fringe benefit. If you're a sole proprietor or single member LLC, then you can deduct gym memberships in the Expenses section of Schedule C. If you're in a partnership or multiple-member LLC, use Form 1065.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.