Loading

Get Ttb F 5300.26 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TTB F 5300.26 online

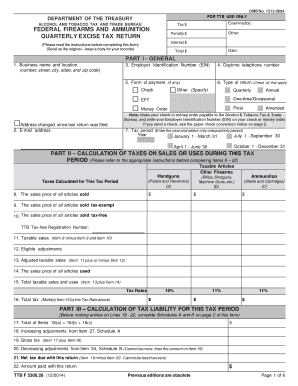

Filling out the TTB F 5300.26 form can be straightforward with the right guidance. This form is essential for reporting Federal Firearms and Ammunition Excise Tax, and ensuring accuracy in your submission will help you avoid penalties.

Follow the steps to accurately complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Input your business name and location in Part I, including the street address, city, state, and zip code.

- Enter your Employer Identification Number (EIN) and ensure the number is correct.

- Fill in your daytime telephone number and email address.

- Select the form of payment you will use for tax, if applicable.

- In the type of return section, check all applicable boxes such as 'Quarterly', 'Annual', or 'Final'.

- Indicate the tax period by entering the year and selecting one quarterly period.

- Complete Item 9 by entering the sales price of articles sold tax-exempt.

- In Item 10, input the sales price of all articles sold tax-free and include your TTB Tax-free Registration Number.

- Calculate and enter the taxable sales in Item 11 by subtracting Items 9 and 10 from Item 8.

- Report any eligible adjustments in Item 12, then calculate adjusted taxable sales in Item 13.

- In Item 16, multiply the total taxable sales and uses by the relevant tax rate to find the total tax due.

- For Part III, complete Schedule A and B as instructed to determine additional adjustments.

- Sign and date the form in Item 36, ensuring an original signature.

- Finally, save changes, download, print, or share the completed form as needed.

Complete your documents online to ensure accurate and timely submissions.

Calculating excise tax involves determining the tax rate applicable to the product and multiplying it by the quantity sold. Different products may have different rates, so it's essential to refer to official guidelines such as those in the TTB F 5300.26 form. Regular tracking and documentation of sales help ensure accuracy in calculations. An organized approach minimizes the risk of errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.