Get Tx Comptroller Ap-209-1 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller AP-209-1 online

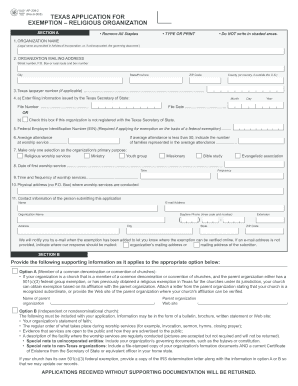

This guide provides users with a clear and supportive approach to filling out the Texas Application for Exemption—Religious Organization (AP-209-1) online. Nonprofit religious organizations seeking tax exemptions can follow these steps to complete the application accurately and efficiently.

Follow the steps to successfully complete the form online:

- Click ‘Get Form’ button to obtain the AP-209-1 and open it in the online editor.

- Begin by entering the organization's legal name in Section A, Question 1. This should match the name provided in your Articles of Incorporation.

- Fill out the organization’s mailing address in Question 2, including street number, city, state, ZIP code, and county.

- If applicable, provide the Texas taxpayer number in Question 3 for identification purposes.

- In Question 4, indicate the filing information from the Texas Secretary of State, or check the box if the organization is not registered.

- Enter the federal Employer Identification Number (EIN) in Question 5 if applying for exemption based on federal status.

- Note the average attendance at worship services in Question 6 and specify the number of families represented if attendance is less than 50.

- Select the organization’s primary purpose in Question 7 by choosing one option from the provided list.

- Fill in the date, time, and frequency of the first worship service in Question 8.

- Provide the physical address where worship services are conducted in Question 10.

- Enter the contact information of the person submitting the application, including name, email, organization name, address, and daytime phone number, in Question 11.

- Review the options in Section B for supporting documents and provide the necessary documentation based on the organization’s affiliation.

- Confirm all information is filled out accurately before completing the form.

- Save changes, and download or print the completed application before submitting it to the Comptroller’s office.

Complete your Texas Application for Exemption—Religious Organization online today!

Get form

Engaging in prohibited political activities, extensive unrelated business income, or failing to adhere to the regulations set forth in the TX Comptroller AP-209-1 can lead to automatic revocation of tax-exempt status. Organizations must be vigilant and maintain compliance to avoid unintended losses of their benefits. Using resources like uslegalforms can offer guidance and clarity on maintaining tax-exempt status.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.