Get Treasurydirect Fs 5396 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TreasuryDirect FS 5396 online

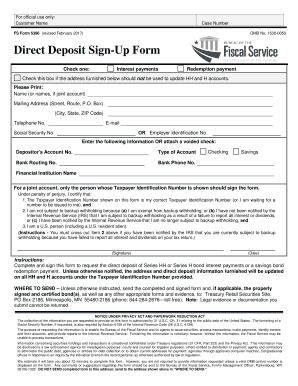

Filling out the TreasuryDirect FS 5396 form is essential for requesting direct deposit services for Series HH or Series H bond interest payments, as well as redemption payments. This guide will provide you with clear, step-by-step instructions to complete the form efficiently and accurately.

Follow the steps to successfully fill out the TreasuryDirect FS 5396 form.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by checking the appropriate box to indicate whether you are requesting interest payments or a redemption payment.

- If necessary, check the box that indicates the address provided should not update your HH and H accounts.

- Provide your name or the names if this is a joint account, and ensure to input your mailing address, including street, city, state, and ZIP code.

- Enter your telephone number and email address, or alternatively, provide your employer identification number or social security number.

- Input the depositor's account number where funds should be deposited, and indicate whether it is a checking or savings account.

- Provide the bank routing number and the name of the financial institution. Also, include the bank's phone number.

- If using a joint account, ensure that only the person whose Taxpayer Identification Number is shown signs the form.

- Read the certification under penalty of perjury and confirm that the Taxpayer Identification Number is correct, and that you are not subject to backup withholding, as applicable.

- Complete the signature line and enter the date of signing.

- Once all fields are completed, you may save changes, download, print, or share the form as needed.

Complete your TreasuryDirect FS 5396 form online today to ensure prompt processing of your direct deposit requests.

Get form

To obtain your tax form from TreasuryDirect, log into your account on the TreasuryDirect website. Navigate to the section for tax documents, where you can access your forms related to interest earned on your bonds. This retrieval process is straightforward and ensures you have all the necessary information for your tax filing. Using TreasuryDirect FS 5396 makes accessing these forms an easy task.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.