Get Tx Comptroller 01-114 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 01-114 online

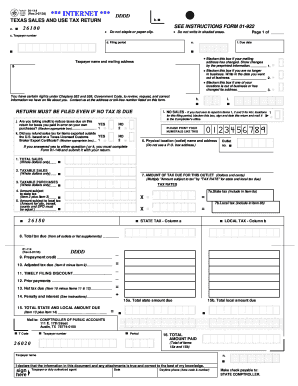

Filling out the Texas Sales and Use Tax Return, known as form 01-114, is an important task for businesses to report their tax obligations accurately. This guide provides step-by-step instructions on how to complete this form online, ensuring users can navigate the process smoothly.

Follow the steps to complete the TX Comptroller 01-114 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In section a, enter your taxpayer number, which is essential for identifying your tax account. Ensure that this number is accurate and matches the documentation you have on file.

- In section b, specify the filing period for which you are reporting sales and use tax. This information is crucial for processing your return accurately.

- Section c requires you to indicate the due date for this filing. Make sure this date is in accordance with the Texas Comptroller's deadlines.

- If your mailing address has changed, blacken the box in section e and update the information accordingly.

- In part 1, you'll find various checkboxes. Use these to indicate if you are no longer in business or if any of your locations have changed. Make sure to fill in the required dates.

- Continue by providing your tax-related information. Fill out the total sales, taxable sales, taxable purchases, and amounts subject to state and local taxes in the provided fields.

- Calculate the amount of tax due for each outlet based on the sales reported. Input these amounts in the specified sections.

- Once all relevant sections are filled, review your entries for accuracy. If applicable, indicate any prepayment credits or discounts in the designated areas.

- Finalize your return by calculating the total amount due. This includes tax due plus any penalties or interest if applicable. Ensure all calculations are accurate.

- You can then save changes, download the completed form for your records, print it for mailing, or share the form as needed.

Complete your forms online today to ensure timely and accurate tax reporting.

Get form

The phone number for Texas corporate tax inquiries is available on the Texas Comptroller's website. Calling this number will connect you with representatives who specialize in corporate tax matters, helping you address any questions regarding TX Comptroller 01-114 efficiently. If you anticipate needing to make frequent inquiries, consider writing down the number or saving it in your contacts for future reference. UsLegalForms can also assist with corporate tax documentation if needed.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.