Loading

Get Canada At4930 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada AT4930 online

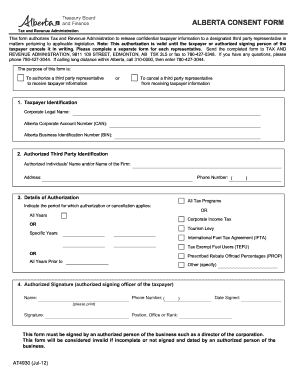

Filling out the Canada AT4930 form is a crucial process for authorizing tax representatives to access confidential taxpayer information. This guide will provide you with clear, step-by-step instructions to complete the form online efficiently.

Follow the steps to fill out the Canada AT4930 form with ease.

- Click the ‘Get Form’ button to obtain the form and open it in your online document editor.

- In the Taxpayer Identification section, enter the corporate legal name, Alberta corporate account number, and Alberta business identification number.

- Proceed to the Authorized Third Party Identification section. Input the authorized individual's name or the firm's name, phone number, and address.

- In the Details of Authorization section, indicate whether the authorization applies to 'All Tax Programs' or specific ones. If specific, select the relevant tax programs and designate the applicable years.

- Complete the Authorized Signature section by providing the name, phone number, date signed, and signature of the authorized signing officer of the taxpayer. Ensure this person holds a valid position within the organization.

- Review all completed sections for accuracy. The form will be considered invalid if incomplete or unsigned. Once satisfied with your entries, you can save changes, download, print, or share the completed form.

Complete your Canada AT4930 form online to ensure efficient processing of your tax representative authorization.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

For a tax return in Canada, you'll need documents such as T4 slips, proof of other income, and details of tax credits. It’s important to collect all relevant receipts and forms beforehand to ensure accuracy. Making a checklist can help you stay organized. The UsLegalForms platform provides helpful resources to ensure you have everything ready for your Canada AT4930 tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.