Loading

Get Conditional Approval Letter Form B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Conditional Approval Letter Form B online

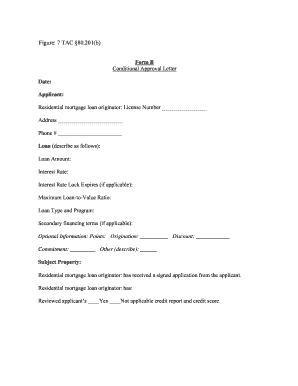

Filling out the Conditional Approval Letter Form B online is a straightforward process. This guide provides clear and comprehensive steps to help you complete the form efficiently and accurately.

Follow the steps to fill out the Conditional Approval Letter Form B online.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Enter the date in the designated field at the top of the form.

- Fill in the applicant's name in the 'Applicant' section.

- Provide the name and license number of the residential mortgage loan originator in the respective fields.

- Complete the address and phone number fields for the loan originator.

- In the 'Loan' section, detail the loan amount, interest rate, and, if applicable, the expiration date of the interest rate lock.

- Specify the maximum loan-to-value ratio and type of loan or program in the provided fields.

- If secondary financing applies, detail the terms in this section.

- For optional information, input the points, origination, and discount details in the provided fields.

- Describe the subject property clearly in the respective field.

- Indicate whether the residential mortgage loan originator has received a signed application from the applicant.

- Review the checkboxes for credit report and credit score, income, available cash for down payment and closing costs, and debts and assets, marking 'Yes' or 'Not applicable' as needed.

- List the conditions for approval under the section provided, ensuring to state any specific requirements.

- Fill in the expiration date for the conditional approval.

- Finally, ensure that the residential mortgage loan originator signs the form at the bottom.

Complete your Conditional Approval Letter Form B online today for a smoother mortgage process.

Related links form

The necessary documents for conditional approval typically include financial statements, identification, and any specific information requested by your lender. It is crucial to review the requirements closely, as they can vary by lender. Comprehensive documentation will improve your chances of a smooth transition to final approval. The Conditional Approval Letter Form B can assist in organizing and submitting these documents correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.