Loading

Get Uk Iht423 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK IHT423 online

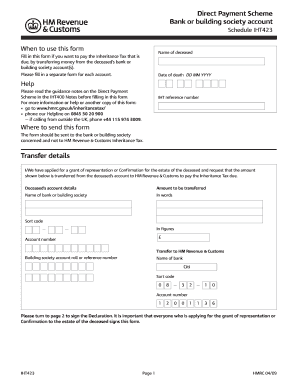

The UK IHT423 form is essential for paying Inheritance Tax from the deceased's bank or building society accounts. This guide provides a clear and supportive walkthrough of the steps needed to complete the form accurately online.

Follow the steps to complete the UK IHT423 form online.

- Click 'Get Form' button to acquire the form and open it in the editor.

- Begin filling in the name of the deceased in the designated field. This should clearly state the full name as it appears on official documents.

- Enter the date of death in the format DD MM YYYY. This information is crucial for processing the Inheritance Tax accurately.

- Locate the IHT reference number and enter it in the specified field. This number is vital for tracking the payment.

- Provide the deceased's account details by filling in the bank or building society name, account number, and sort code. Ensure accuracy to avoid delays.

- State the amount to be transferred in both words and figures. Double-check this section to ensure correct values are provided.

- Complete the transfer details section by confirming that you have applied for a grant of representation or Confirmation for the estate of the deceased.

- Proceed to the Declaration section on page two. All representatives must provide their personal information, signatures, and dates of signature.

- After completing the form, ensure you save any changes. Review the information for accuracy before finalizing.

- Once completed, download, print, and share the form as required, sending it directly to the concerned bank or building society for processing.

Start completing your UK IHT423 form online today to ensure your Inheritance Tax payment is processed smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A taxable estate includes all assets that exceed the Inheritance Tax threshold and may be subject to tax. In contrast, a probate estate consists of the total assets requiring a legal process upon the deceased's passing, which may or may not trigger tax liabilities. Understanding these distinctions is vital for estate planning, especially when preparing documentation like the UK IHT423.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.