Get Uk Irp3(b)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK IRP3(b) online

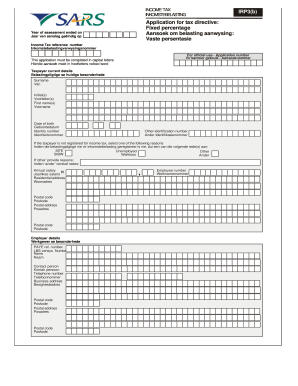

Completing the UK IRP3(b) form online is essential for applying for a tax directive. This guide will walk you through each section of the form, ensuring that you provide accurate information to facilitate a smooth application process.

Follow the steps to successfully complete your application.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the year of assessment that ended, followed by your income tax reference number, which is crucial for processing your application.

- Complete the taxpayer's current details section. This includes your surname, initials, first name, date of birth, identity number, and any other identification numbers if applicable.

- If you are not registered for income tax, select the reason from the available options, including unemployed or other. If selecting 'other', please specify your reason.

- Enter your annual salary and residential address, including the postal code. You must also provide your postal address if different from your residential address.

- Fill out your employer details by including the PAYE reference number, employer's name, contact person, telephone number, business address, and postal details.

- Provide additional details about your employment, specifically the date of employment and the reason for the directive, marking it as commission, contractor, or personal services.

- Indicate whether a fixed percentage directive was issued for the previous year of assessment by selecting 'yes' or 'no'.

- Complete the fixed percentage deduction section, providing your calculations in the designated area. Ensure that your calculations accurately reflect your gross income and admissible expenditures.

- Finally, attach any necessary explanations or documentation related to your application. Review all details to ensure accuracy.

- Once all sections are complete, you can save your changes, download, print, or share the completed form as needed.

Complete your application for a tax directive online today to ensure timely processing.

The BR tax code in the UK indicates that all earnings are subject to basic rate tax, currently set at 20%. This code is often assigned to individuals who have multiple sources of income and lack a personal allowance due to previous tax codes. It's essential to ensure that your tax code accurately reflects your situation to avoid overpayment. For personalized advice, consider reaching out to uslegalforms, where you can find tailored solutions for your tax inquiries.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.