Loading

Get Annual Summary Of Withholding Tax For Crs-1 Filers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ANNUAL SUMMARY OF WITHHOLDING TAX FOR CRS-1 FILERS online

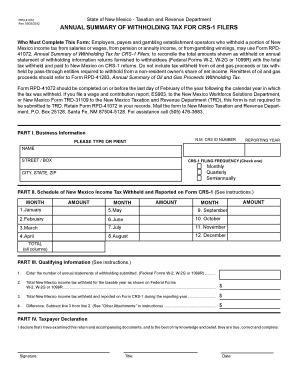

This guide provides comprehensive instructions for completing the Annual Summary of Withholding Tax for CRS-1 Filers online. It is designed to support employers, payers, and gambling establishment operators in reconciling total amounts withheld and ensuring compliance with New Mexico tax regulations.

Follow the steps to successfully fill out the document.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, enter the number of annual statements of withholding submitted. This includes Federal Forms W-2, W-2G, or 1099R.

- Provide the total New Mexico income tax withheld for the taxable year as shown on the respective federal forms.

- Indicate the total New Mexico income tax withheld and reported on Form CRS-1 during the reporting year.

- Calculate the difference by subtracting the amount in step 3 from the amount in step 2. Document this amount in the designated area.

- In Part II, complete the Schedule of New Mexico Income Tax Withheld and Reported on Form CRS-1 by listing the amounts for each month from January to December.

- In Part III, provide any qualifying information required, including your CRS-1 filing frequency and your CRS ID number.

- In Part IV, sign the form, add your title, and date it. Ensure that you declare the accuracy of the information provided.

- Once all sections have been completed, save your changes. You can then download, print, or share the completed form as needed.

Complete your documents online today to ensure compliance and accuracy.

Single Tax Withholding Table If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $6,275 but not over $11,775$0.00 plus 1.7% of excess over $6,275Over $11,775 but not over $17,275$93.50 plus 3.2% of excess over $11,775Over $17,275 but not over $22,275$269.50 plus 4.7% of excess over $17,2757 more rows • May 7, 2021

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.