Loading

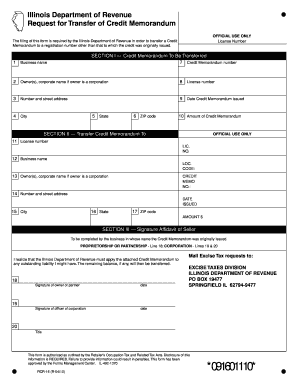

Get Rcr-16 Request For Transfer Of Credit Memorandum. Request For Transfer Of Credit Memorandum - Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RCR-16 Request For Transfer Of Credit Memorandum - Tax online

Filling out the RCR-16 Request For Transfer Of Credit Memorandum is a necessary process for transferring a credit memorandum to a different registration number. This guide will walk you through each section of the form with clear instructions to ensure a smooth completion.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section I, begin by entering the business name in the designated field. This is the name associated with the credit memorandum you wish to transfer.

- Specify the owner(s) or the corporate name if the owner is a corporation. This identifies the entity that originally possessed the credit memorandum.

- Fill in the number and street address of the business as part of identifying information.

- Include the state in which the business operates.

- List the credit memorandum number, which is necessary for tracking the specific credit being transferred.

- Write down the license number associated with the business.

- Indicate the date the credit memorandum was issued.

- In Section II, provide the license number where the credit memorandum is to be transferred. This aligns the credit with the new registration number.

- Enter the business name for the new license number. Ensure it matches the registration to which the credit will be transferred.

- Fill in the owner(s) or corporate name if applicable for the new business.

- Provide the number and street address for the new business.

- Specify the city related to the new business address.

- Enter the state where the new business operates.

- Fill in the ZIP code of the new business location.

- Complete Section III by signing the affidavit of the seller. If the business is a proprietorship or partnership, the owner or partner must sign in the designated area. For corporations, the authorized officer must sign.

- Include the date next to the signature to confirm when the form was completed.

- If applicable, provide the title of the person signing the form.

- Review all entered information for accuracy to avoid any filing issues.

- Once all sections are complete, save your changes, then download, print, or share the form as necessary.

Start completing your RCR-16 Request For Transfer Of Credit Memorandum online today.

You should file Form ST-6, Claim for Sales and Use Tax Overpayment/Request for Action on a Credit Memorandum, if you are a registered retailer who has • a sales and use tax overpayment on file and you want to - convert this overpayment to a credit memorandum, or - convert it to a credit memorandum and transfer ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.