Loading

Get Irs W-9(sp) 2018-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-9(SP) online

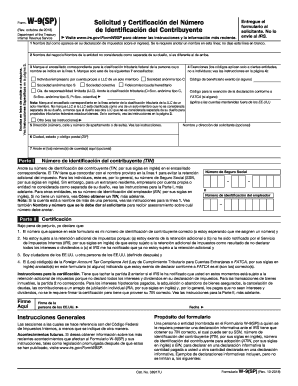

Filling out the IRS W-9(SP) form online is essential for individuals and entities in the United States to provide accurate taxpayer identification information. This guide will walk you through each section of the form to ensure you complete it correctly and efficiently.

Follow the steps to fill out the IRS W-9(SP) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as it appears on your income tax return in the first field. Ensure it is not left blank, and write it in block letters or type it.

- In the second field, provide your business name, or the name of the entity disregarded as separate from the owner if it differs from the name in step 2.

- Mark the corresponding box to indicate the federal tax classification of the person listed on line 1. Only select one of the options: Individual/sole proprietor/LLC single-member, S corporation, partnership, C corporation, trust/estate, etc.

- If applicable, you may need to enter exemption codes in line 4 for certain entities. Refer to the instructions for specific codes that apply.

- Fill in your address in line 5 including the number, street name, apartment or suite number as necessary.

- Provide your city, state, and ZIP code in line 6.

- If you want, enter your account number(s) in line 7.

- In Part I, write your Tax Identification Number (TIN) in the designated box. For individuals generally this will be your Social Security Number (SSN). For other entities, this will be your Employer Identification Number (EIN).

- In Part II, certify your information by signing and dating the w-9. Your signature verifies that the TIN you provided is correct and that you are not subject to backup withholding.

- Once all fields are completed, you can save the changes, download the form, print it, or share it as needed.

Complete your IRS W-9(SP) online now to ensure compliance and avoid potential tax withholding issues.

Yes, you need to report any income received that is documented through a W-9(SP) form on your tax returns. The income reported by the payer is based on the information provided in the W-9(SP). Properly reporting this income helps you stay compliant with tax laws and avoids potential penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.