Loading

Get Canada T2201 E 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2201 E online

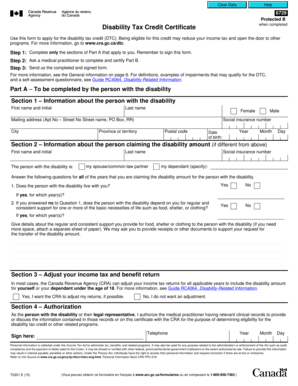

The Canada T2201 E form is essential for applying for the disability tax credit, which can help reduce your income taxes and provide access to additional benefits. This guide will guide you through the process of completing the form online, ensuring you provide all the necessary information.

Follow the steps to complete the Canada T2201 E form online.

- Press the ‘Get Form’ button to access the Canada T2201 E form and open it in your preferred editor.

- Complete Part A of the form, providing your personal details in Section 1. Fill out your first name, last name, mailing address, social insurance number, date of birth, and indicate your province or territory.

- In Section 3, decide if you want the Canada Revenue Agency (CRA) to adjust your income tax returns to include the disability amount. Indicate your choice.

- Ensure that all sections you filled out are accurate and complete. Review the information provided in Part A.

- Send the completed and signed form to the Disability Tax Credit Unit at the appropriate tax center using the guidelines provided in the form.

Complete your Canada T2201 E form online today to take a step towards accessing the disability tax credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The Canada Disability Tax Credit is calculated based on several factors, such as your level of disability and the associated expenses. Once you file the Canada T2201 E form, the Canada Revenue Agency will assess your application for eligibility. If approved, you may receive a non-refundable tax credit that significantly reduces your tax burden.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.