Loading

Get Form 318

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 318 online

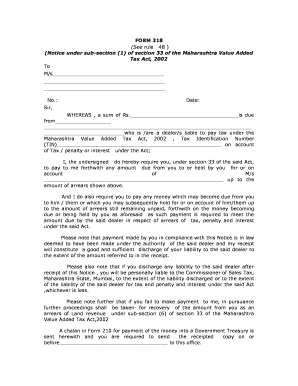

Filling out Form 318 online can be straightforward if you follow the provided guidance. This user-friendly guide will walk you through each section of the form to ensure that you complete it accurately and efficiently.

Follow the steps to fill out Form 318 quickly and accurately.

- Press the ‘Get Form’ button to access the form and open it in your online document editor.

- Begin by entering the name of the recipient after ‘To M/s’ on the form. This should include the complete name and details of the individual or entity being addressed.

- Next, insert the form number and date in the designated fields to ensure proper tracking of the document.

- In the section that specifies the amount due, enter the sum of money owed, ensuring accuracy to avoid any errors.

- Provide the Tax Identification Number (TIN) of the dealer to maintain clarity and specificity in your documentation.

- Complete the section that addresses payment instructions and liabilities, including any necessary details about how the payment should be made.

- Review the notice requirements thoroughly to ensure you understand the obligations and potential consequences of non-compliance.

- Finally, save your changes, then download, print, or share the form as required to make sure it reaches the appropriate parties.

Take the next step and complete your paperwork online today!

Related links form

An individual receives a discharge for most of his or her debts in a chapter 7 bankruptcy case. A creditor may no longer initiate or continue any legal or other action against the debtor to collect a discharged debt. But not all of an individual's debts are discharged in chapter 7.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.