Loading

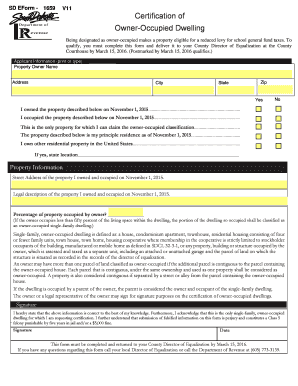

Get Qualify, You Must Complete This Form And Deliver It To Your County Director Of Equalization At The

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qualify, You Must Complete This Form And Deliver It To Your County Director Of Equalization At The online

Completing the Qualify form is an important step in certifying an owner-occupied dwelling, which may allow for a reduced levy on school general fund taxes. This guide will provide you with clear, step-by-step instructions to ensure you fill out the form correctly and deliver it to your County Director of Equalization.

Follow the steps to successfully complete your form online.

- Click ‘Get Form’ button to access the form and open it in your editing tool.

- Fill in the applicant information section where you provide your name, address, city, state, and zip code. Make sure to use clear and legible text, whether typing or writing.

- Indicate whether you owned the property as of November 1, 2015, and whether you occupied it on that same date by selecting 'Yes' or 'No' for each question provided.

- Confirm this is the only property for which you can claim the owner-occupied classification and that it is your principal residence as of November 1, 2015. Answer accordingly.

- If you own other residential property in the United States, provide the location of such property. This information is necessary for the classification process.

- In the property information section, enter the street address of the property you owned and occupied on November 1, 2015. Also provide the legal description of this property.

- Specify the percentage of the property occupied by the owner. Remember, if this percentage is less than fifty, only that portion can be classified as owner-occupied.

- Review the definition of a single-family, owner-occupied dwelling to ensure that your property qualifies under the specified criteria.

- Ensure you or a legal representative will sign the form, confirming the information provided is correct to the best of your knowledge. Be aware that providing false information can lead to serious consequences.

- Save the changes made, and use the print function to generate a hard copy of the form for mailing to your County Director of Equalization.

Complete your documentation online and ensure timely submission.

Proposition 58 and 193 are constitutional provisions that provide property tax relief by excluding from reassessment the transfer of a principal residence and the transfer of up to one million dollars ($1,000,000) of other real property between parents and children or from grandparent to grandchild.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.