Loading

Get Beneficiary Form457b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Beneficiary Form457b online

Filling out the Beneficiary Form457b is an essential step in ensuring your assets are allocated according to your wishes. This guide provides a step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to complete the Beneficiary Form457b online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

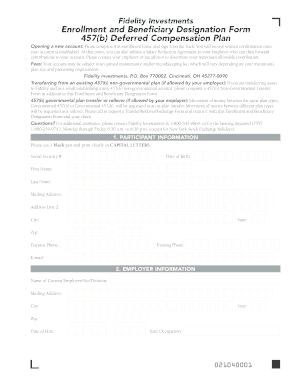

- In the Participant Information section, provide your Social Security number, date of birth, first and last name, mailing address, city, state, zip code, daytime phone, evening phone, and email address. Use a black pen and print clearly in capital letters.

- In the Employer Information section, enter the name of your current employer, their mailing address, city, state, zip code, date of hire, and your occupation.

- Move to the Selection of Investment Options section and indicate the percentage of your contributions that you wish to allocate to the investment options available under your employer’s plan. Ensure the total equals 100%.

- In the Designating Your Beneficiary(ies) section, specify your primary and contingent beneficiaries. Each group must total 100%, and your primary and contingent beneficiaries must be distinct.

- Complete the necessary information for each beneficiary, including their name, Social Security number or trust name, percentage allocation, date of birth or trust date, and relationship to you.

- If desired, designate additional beneficiaries on a separate paper, ensuring to attach and sign it. Make sure that the designations align with the form's requirements.

- In the Authorization and Signature section, review the statements and sign the form, dating it accordingly.

- Finally, save changes, download, print, or share the completed form as necessary.

Complete your documentation process online to ensure your beneficiary designations are properly filed.

In the context of a 457 plan, a beneficiary is a person or organization that you select to receive the funds from your 457 retirement account upon your death. This designation is crucial, as it determines how your retirement savings will be allocated. By filling out the Beneficiary Form457b, you have the opportunity to tailor your beneficiaries based on your personal situation and preferences.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.