Loading

Get Tax Payer Status Affidavit Identity Verification - Sos Ri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Payer Status Affidavit Identity Verification - Sos Ri online

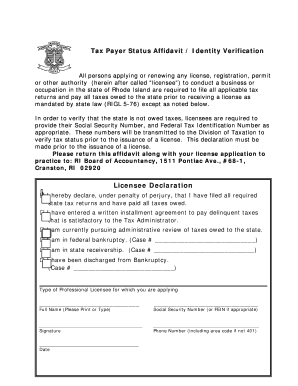

Filling out the Tax Payer Status Affidavit Identity Verification - Sos Ri is a crucial step for individuals applying for or renewing licenses in Rhode Island. This guide provides detailed, user-friendly instructions to ensure a smooth online completion of the form.

Follow the steps to complete the affidavit online.

- Click the ‘Get Form’ button to access the affidavit form and open it in your preferred online editor.

- Begin by reading the purpose of the form which states the requirement for tax verification prior to receiving a license. This ensures you understand the importance of the submission.

- In the 'Licensee Declaration' section, tick the appropriate checkbox that accurately represents your tax situation. You can choose one of the following options: confirming you have filed all required returns, entering into an installment agreement, pursuing an administrative review, or indicating bankruptcy status.

- Specify the type of professional license you are applying for in the provided space. This defines the category for which the affidavit is being submitted.

- Print or type your full name clearly in the designated field to identify yourself as the licensee.

- Input your Social Security Number or Federal Employer Identification Number (FEIN) in the appropriate field to facilitate tax verification.

- Sign the affidavit to confirm that all information provided is accurate and complete.

- Provide your phone number, including area code, to enable contact if further information is necessary.

- Enter the date of completion in the designated section, which confirms when you filled out the affidavit.

- Once all sections are completed, save your changes, and download a copy of the form for your records. You may also print the form or share it as required.

Complete your Tax Payer Status Affidavit Identity Verification - Sos Ri online today!

Rhode Island – like the federal government and many states – has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.