Loading

Get Fill In Wv Nipa 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill In Wv Nipa 2 online

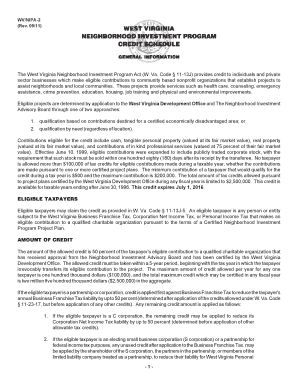

The Fill In WV NIPA 2 is a crucial form for claiming tax credits under the West Virginia Neighborhood Investment Program. This guide provides step-by-step instructions to help users complete the form efficiently and accurately.

Follow the steps to fill out the Fill In WV NIPA 2 form online.

- Press the ‘Get Form’ button to access the form and open it in the editing tool.

- Enter your name, Tax Identification Number or Social Security Number, and the tax period for which you are filing.

- In Line 1, provide the project number for each project for which you are claiming a credit, along with the corresponding tax credit amount from Form WV/NIPA-1. If you have more than three projects, attach an additional page and include a voucher for each project.

- For Line 2, input the project number and the amount of credits carried forward from previous years.

- Line 3 should reflect the total Neighborhood Investment Program Credit by adding the amounts in Lines 1 and 2.

- Line 4 requires you to enter the lesser amount between the total allowable credit from Line 3 and $100,000.

- If you are part of a partnership or S corporation, complete lines 5a through 8f, detailing your Business Franchise Tax liability and the credit you want to apply.

- If you are filing as an individual or sole proprietor, complete lines 9a through 9d, providing your income tax due and the applicable credit.

- After filling out all the necessary lines, review your information for accuracy. Save your changes.

- Once completed, you can download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth submission process.

As of now, West Virginia does not tax Social Security benefits, and there are talks regarding further tax relief for retirees. However, the legislation may change, so it's beneficial to stay informed. If you're concerned about current policies, use fill in WV NIPA 2 to ensure compliance and understand your benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.