Get Web 9 Spf100 Schedule Sp.pmd - State Wv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WEB 9 SPF100 SCHEDULE SP.pmd - State Wv online

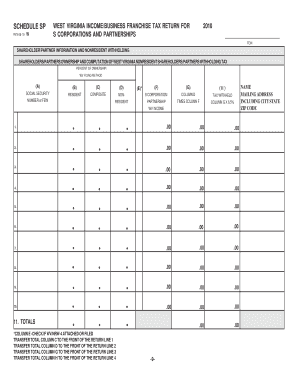

Filling out the WEB 9 SPF100 SCHEDULE SP.pmd form is an essential step for S corporations and partnerships operating in West Virginia. This guide will provide you with a clear, step-by-step approach to effectively complete the form online.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access the form and open it in your preferred viewer.

- Begin filling out the form by entering the Federal Employer Identification Number (FEIN) at the top of the document. This unique number identifies your business entity.

- Provide the necessary shareholder or partner information, including their names, addresses, and Social Security numbers in the designated fields to ensure accurate identification.

- Indicate the percent of ownership for each shareholder or partner in column A. This information is critical for calculating tax liabilities.

- In the following columns, input the applicable West Virginia income and computation of the nonresident withholding tax for each individual listed, following the structured format provided.

- Complete the tax withheld calculation by multiplying the nonresident shareholder's income by the appropriate percentage, noting the results in columns G and H.

- Summarize the totals of the income and taxes withheld in the final sections to ensure all calculations are complete and accurate.

- Before finishing, verify if a WV/NRW-4 form is attached or filed by checking the appropriate box in column E.

- Transfer the totals from columns C, D, G, and H to the front of the return as indicated, aligning them with the required line numbers for submission.

- Once all sections are filled out, review the document for any errors or missing information, then save the changes, and prepare to download, print, or share the finalized form.

Begin filling out your documents online today.

The composite tax rate in West Virginia varies depending on income levels, but it generally includes several brackets, each with its own specific rate. For accurate calculations, especially regarding documents like the WEB 9 SPF100 SCHEDULE SP.pmd - State Wv, taxpayers should refer to the latest guidelines from the West Virginia State Tax Department. It's advisable to consult a tax professional or use online platforms like uslegalforms to navigate this process easily.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.