Loading

Get 45 106f9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 45 106f9 online

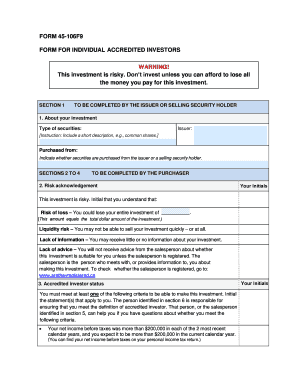

Filling out the 45 106f9 form is an essential step for individual accredited investors seeking to make informed investment decisions. This guide will walk you through each section of the form, ensuring you understand the requirements and can complete it effectively.

Follow the steps to successfully complete the 45 106f9 form.

- To begin, press the ‘Get Form’ button to access the form. This will allow you to open it in the editor where you can start filling it out.

- In section 1, you need to provide information about your investment. Enter the type of securities, such as 'common shares,' and specify whether you purchased them from the issuer or a selling security holder.

- Next, move to section 2, where you acknowledge the risks associated with the investment. Initial each statement to confirm your understanding, including the risk of loss, liquidity risk, lack of information, and lack of advice from the salesperson.

- Proceed to section 3 to confirm your accredited investor status. Initial the applicable statements that demonstrate you meet the accreditation criteria, such as income levels or net asset thresholds.

- In section 4, print your first and last name, and provide your signature to confirm you have read and understood the risks outlined in this form.

- Section 5 requires information about the salesperson. Print the salesperson's first and last name, along with their telephone number, email address, and the name of their firm if registered.

- Finally, in section 6, provide additional information about the investment, including the issuer or selling security holder's details. Ensure that all required contact information is correctly filled in.

- Once you have completed the form, save your changes. You can then download, print, or share it as needed.

Start filling out the 45 106f9 form online today to take the next step in your investment journey.

Accredited Investor Definition The SEC defines an accredited investor as someone who meets one of following three requirements: Income. Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.