Loading

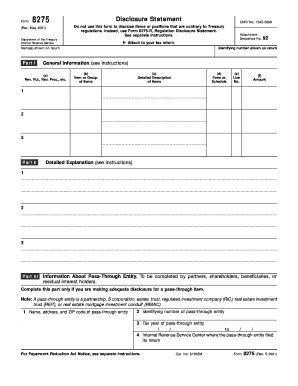

Get Form 8275 (rev. May 2001) (fill-in Capable)

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8275 (Rev. May 2001) (Fill-In Capable) online

Form 8275 is a disclosure statement used for reporting certain tax positions that are contrary to Treasury regulations. This guide provides clear, step-by-step instructions tailored to help users fill out the form online, ensuring they can complete it with confidence.

Follow the steps to successfully complete Form 8275 online.

- Click the ‘Get Form’ button to retrieve the form and open it in your preferred digital workspace.

- In Part I, enter the names as shown on your tax return in the designated field for name(s). Next, provide the identifying number associated with your return.

- Fill in section (a) with any relevant revenue rulings or procedures. In section (b), indicate the item or group of items being disclosed. Section (c) requires a detailed description of the items, while section (d) should contain the related form or schedule. Enter the corresponding line number in section (e) and the amount in section (f). Repeat this process for each relevant item.

- Proceed to Part II to provide any further detailed explanations related to your disclosures from Part I. Number your explanations for clarity.

- Complete Part III if applicable, providing information about any pass-through entity involved. Include the name, address, and ZIP code of the entity, its identifying number, tax year, and the IRS center where the entity filed its return.

- In Part IV, add any additional explanations required, referencing previous sections as needed to maintain clarity.

- Once you have filled out all sections, review the form for any errors or missing information. You can then save your changes, download a copy for your records, print the form, or share it as needed.

Start completing your Form 8275 online today to ensure accurate and timely disclosures.

Related links form

Many professionals can assist you in filling out IRS forms, including tax preparers, accountants, and financial advisors. Additionally, online platforms like uslegalforms provide resources and tools to help you fill out forms like Form 8275 (Rev. May 2001) (Fill-In Capable) on your own. Depending on your preference, you can choose personal assistance or utilize helpful online options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.