Loading

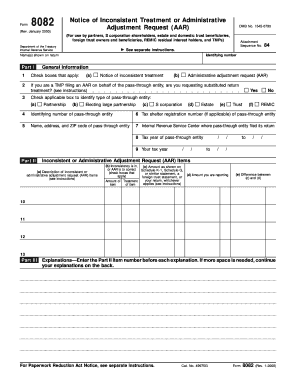

Get Form 8082 (rev. January 2000). Notice Of Inconsistent Treatment Or Amended Return - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 8082 (Rev. January 2000). Notice Of Inconsistent Treatment Or Amended Return - Irs online

Form 8082 is used to notify the Internal Revenue Service about inconsistent treatment or to submit an administrative adjustment request. This comprehensive guide will help you navigate the steps to fill out the form accurately and efficiently.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to access the form and open it in your chosen document editor.

- Begin by providing your identifying number as required at the top of the form.

- In the general information section, check the appropriate boxes that apply to your situation, including if you are a tax matter partner (TMP) filing on behalf of a pass-through entity.

- Identify the type of pass-through entity by marking the applicable box (partnership, electing large partnership, S corporation, estate, trust, or REMIC).

- Fill in the identifying number of the pass-through entity and the name, address, and ZIP code of that entity.

- If applicable, include the tax shelter registration number of the pass-through entity.

- Specify the Internal Revenue Service Center where the pass-through entity filed its return.

- Indicate the tax year of the pass-through entity and your own tax year.

- In Part II, provide a description of the inconsistent or administrative adjustment request items you are addressing.

- Fill in the inconsistencies or adjustments as they correspond to amounts reported on Schedule K-1, Schedule Q, or any related statement, indicating how they apply to your return.

- Report the amounts you are correcting and calculate the difference between the amounts shown and your reported amounts.

- In Part III, provide detailed explanations for each item in Part II, referencing the item numbers. Use additional space on the back if necessary.

- After completing the form, ensure all information is accurate. Save your changes, then download and/or print the form for submission.

Complete your Form 8082 online today to ensure your taxes are handled correctly.

Receiving a letter from the IRS regarding an amended return often indicates that they have questions or need clarification about your submission. Review the correspondence carefully, as it may request information related to Form 8082 (Rev. January 2000). Notice Of Inconsistent Treatment Or Amended Return - IRS is part of the IRS's process to ensure accuracy and compliance with tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.